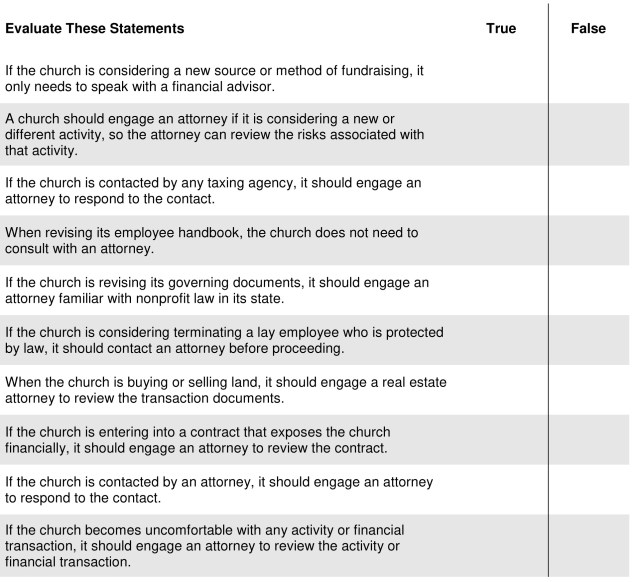

The church usually begins looking for an attorney only when it is confronted with a crisis—such as being served with a lawsuit. However, the need for an attorney’s advice actually arises during the planning stages of any activity or event. Take the following quiz to test if you know when it’s time to hire an attorney. The answer key is at the end of the article.

Download a PDF version of this checklist.