Featured Articles

Federal Tax Law Changes Churches and Clergy Must Know for 2025–2026

A major new law—the One Big Beautiful Bill Act—plus court rulings and IRS actions brought 50 federal tax developments that churches and clergy need to track for 2025 tax returns and 2026 compliance. This overview highlights a portion of that list.

Beware the Holiday ‘Overpay-and-Refund’ Scam

A holiday-weekend “mistake donation” turned into a costly scam for one church when a fraudulent donor pressured staff into issuing a partial refund before the original gift cleared.

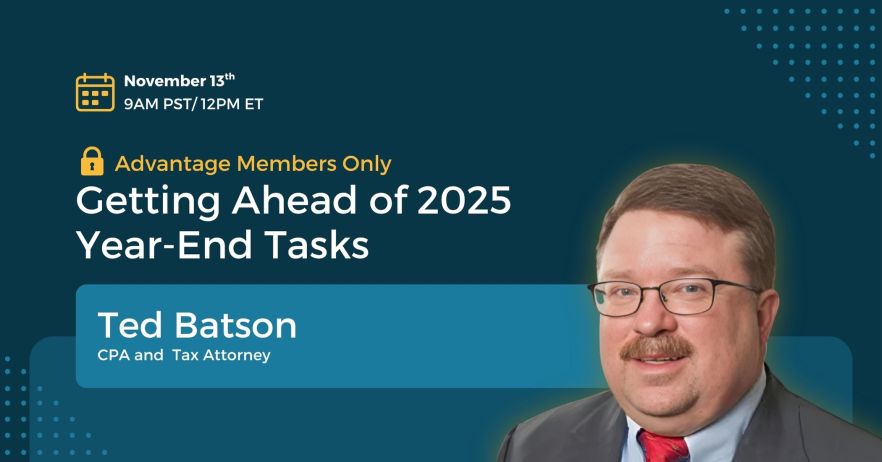

On-Demand Webinar: Ending 2025 Well for Church Leaders

This exclusive webinar with CPA and Tax Attorney Ted Batson is perfect for church leaders wanting guidance on end-of-year tasks and responsibilities.

Mastering Eighteen End-of-Year Financial Tasks

Mastering eighteen end-of-year financial tasks before January 1, 2026, will help churches and ministers thrive with the upcoming tax season.

Designating a Housing Allowance for 2026

Designating a housing allowance is a critical part of every church’s pastoral compensation package and a key tax benefit for pastors.

Find it Fast.

Browse by topic to find the answer you need to lead your ministry with confidence.

Stay informed. Keep learning.

Browse by topic to find the answer you need to lead your ministry with confidence.

Church Law & Tax Products

Church IT, 3rd Edition

This updated and expanded edition of Church IT offers practical guidance on careful, strategic approaches for leveraging IT effectively to advance the church’s mission.

Pastor, Church & Law, Fifth Edition

Learn which local, state, and federal laws apply to religious organizations.

20 Finance Questions Churches Ask

Richard Hammar answers relevant tax and finance questions for church leaders.

2025 Church & Clergy Tax Guide

Support your ministry with the most authoritative and comprehensive, year-round tax resource.