Developing a total compensation strategy and plan for your church does not have to be an overwhelming process, but it is a multifaceted one. There are many factors that need to be considered prior to deciding how and what to compensate ministers and other employees.

Often church leaders pattern their pay strategies and benefits plans after the church down the street or a peer church in another city. But this approach creates a cultural and operational disconnect, while also potentially creating unnecessary legal and tax liabilities. A more effective strategy is designing a plan from scratch—one reflecting the church’s own unique culture and dynamics while recognizing market realities.

Building such a compensation plan from scratch is possible, regardless of a church’s age and current situation. It requires a very intentional process. And it requires collaboration, starting with buy-in from the entire leadership team.

Assess your church’s culture

The ability to update and improve the church’s compensation philosophy and policy depends upon a clear understanding of your internal culture—taking stock of talent needs and financial resources that will later become important as your church assesses the broader employment landscape. This, in turn, begins the process of mapping out a strategy.

This article is not focused on the detailed process of assessing and analyzing your culture, but do keep one thing in mind here: Do not assume that your church’s vision and mission statements or the values of the organization alone represent the culture. These are important pieces of the puzzle for creating it, but how you act as a church matters as much, if not more, than what your church says about itself.

Once there is a collective understanding of the church’s culture—its core values and how they parlay into the vision and mission of the organization—leadership can then move forward in developing a meaningful pay philosophy and policy that blends with that culture. For example, what does your church offer that will draw potential employees to it? What are your unique and most attractive qualities? What is it about your mission that sets it apart from other congregations? The answers to questions like these should be written into your policy.

Shape a policy

A good compensation policy should support your church’s vision, mission, strategic plan, and key performance initiatives, as well as ministry goals, operating objectives, and, ultimately, a compensation-setting strategy.

The components behind a strong policy should cover details such as:

- How the church will compensate its employees—identifying the components (pay, benefits, retirement, housing, and so on) that will be offered and explaining how your church will execute the plan.

- Direction on how to attract people to become valued members of your church staff.

- Guidance on how to motivate employees to perform at the best of their abilities, skill sets, and competencies.

- Specific ways you will strive to retain key talent and reward high-performing employees.

It is also important that your policy reflects an understanding of the competitive market of your local community and of the larger church community. The reality is that you are in competition not only with other churches but also with other nonprofit organizations and even some for-profit organizations. A policy that demonstrates a clear understanding of this market reality will guide decisions about base pay and total compensation packages—including pay grades, salary ranges, incentive plans, healthcare offerings, benefits, savings and retirement, and other compensation areas based on financial and operational resources.

A solid policy must also ensure that the church board’s approach to senior leadership compensation and total rewards is reasonable and not excessive. For additional guidance in this area, see the “intermediate sanctions” section in “Tax Law and Compensation Planning” (page 10), “Setting Reasonable Compensation” (page 15), and “The Compensation Consultant Option” (page 16).

Establishing a solid compensation policy often requires balancing base pay and cash incentives with benefits such as healthcare, vacation, sick leave, paid time off, and adjustments to the work environment. However, based on my consulting experiences, base pay (cash) has become king with many church employees today. Given the rapidly increasing costs of healthcare and other benefits that oftentimes have been passed on to them, employees end up with less cash in their wallets. More base pay counteracts this dynamic.

An effective and legally sound compensation policy should pass the following quality test:

- Is the overall program equitable to all concerned (ethnicity, gender, age, etc.)?

- Can the church readily defend its compensation policy and procedures from a legal and regulatory perspective?

- Is the overall plan fiscally sensitive and reflective of the availability of church financial resources?

- Is the overall plan legally compliant with all federal, state, and local employment benefits and retirement laws and regulations?

- Can the organization effectively communicate the philosophy, policy, and overall plan to employees? Are communications clear and simple?

- Are the various compensation and benefits plans the church offers fair, competitive, and in line with the church’s culture and with the compensation philosophy and policies published by the church?

Understand current costs

Next, you want to understand the current realities affecting your church’s compensation-setting strategy. This information helps begin to establish a baseline for both what you want to include and what you can afford to include.

Start by reviewing and pricing the following variables:

- Direct cash compensation: wages/base salary; bonus/incentives; cash donations/love offerings, other cash payments;

- Paid time off: vacation, sick leave, personal leave, bereavement leave, other leave with pay;

- Health benefits: employee/spouse/family medical, dental, vision, prescription drug plan, annual physicals, disability insurance (short- and long-term);

- Life insurance, accidental death and dismemberment (AD&D);

- Flexible Spending Accounts (FSAs);

- Social Security—employer match;

- Workers’ compensation contribution;

- Retirement/savings plans: 401(k), 403(b), defined benefit/pension plans, supplemental executive retirement plans (SERPs);

- Automobile allowance/automobile provided for personal use;

- Health/dinner club membership;

- Interest-free or below-market loans;

- Deferred compensation plans;

- Supplemental executive health/life/disability insurance;

- Housing: annual parsonage allowance or housing allowance;

- Moving/relocation allowances;

- Financial, tax, and estate planning;

- Legal services;

- Counseling services;

- Educational assistance/tuition reimbursement and related expenses;

- Cell phone, email, and personal internet service reimbursement;

- Other compensation-related items.

Notable Compensation Trends

It’s important to establish some broad understandings regarding compensation and benefits, both in terms of statistics and trends.

For instance, regarding the remainder of 2018 and the early part of 2019, ChurchSalary.com and other sources of information—including my own work with churches—reveal the following big-picture quantitative view:

• Average annual pay increases will continue to trend between 2.8 and 3.2 percent for the rest of 2018. How base salary increases are allocated by an organization will vary by the individual employee, the organization’s resources, and so on.

• A number of states and cities have recently enacted or are discussing potential increases to minimum wages. Separately, executive compensation may require restructuring with the changes enacted through the Tax Cuts and Jobs Act of 2017, affecting tax deductions for performance-related compensation in public companies, potential excise taxes on executive compensation in not-for-profits, and related impacts on deferred compensation plans.

CAUTION Whether minimum wage or high-level executive pay, these issues may require churches to significantly restructure numbers for their compensation plans.

• The possible modifications to the Affordable Care Act (ACA) will continue to shake up the health insurance marketplace. Furthermore, the uncertainty and high cost of health care, coupled with generational differences and preferences regarding pay and employee benefits, are causing organizations to rethink what they provide, how much they provide, and how it is provided.

In addition, salary data sources tell us more about these current qualitative compensation-related trends:

• More organizations are using variable and incentive compensation plans to reward employees who attain certain goals or achieve certain metrics.

• Many organizations are paying more attention to nontraditional benefits and quality-of-work-life rewards that they can provide to employees. These include:

- Cash awards, sports tickets, and/or entertainment certificates to recognize outstanding achievements and contributions;

- Performance recognition, thank-you notes, get-well cards, and birthday celebrations;

- Prepaid legal assistance and concierge services;

- Time off to participate and volunteer in community and charitable causes;

- Flexible work schedules, job-sharing, part-time employment, and telecommuting;

- Bonus days off, fun days, and retreats;

- Educational assistance, career development, and training;

- Transportation allowances and parking passes;

- Massage therapy, health club memberships, and workplace wellness initiatives;

- Discounted childcare programs; and

- Retirement planning and financial management.

• Greater momentum toward organizations evaluating and changing their culture and compensation philosophy and policy, with a focus on designing, developing, and sustaining a compensation plan to attract talented people, retain key employees, and maintain and engage a motivated workforce.

Together, what these qualitative and quantitative trends currently reveal is that many organizations are rethinking their total compensation strategies and systems. There is a real emphasis for understanding average pay levels and increases, but on a deeper level, a sense that churches and other nonprofit organizations need their total compensation offerings to reflect their culture and keep them competitive with other employers.

To do so, they’re looking at issues like pay fairness and equity, rewards and recognition for key performance indicators and goal achievement, use of variable pay programs to reward for job performance and workplace contributions, work-life rewards, flexible work scheduling, and educational and career training and development.

Understand the big picture

After analyzing your culture, creating your compensation philosophy and policy, and understanding current costs, it’s time to identify valid compensation survey sources that can be used for comparing jobs and compensation with positions within your church. This data will be used to “benchmark” your church’s own salary ranges and compensation packages for each employment position (which we will explore later in this article, along with the accompanying sidebars).

Key point. If your church underpays employees, those employees may eventually look for another place to work—one they perceive will compensate them more fairly and reasonably. This situation can get expensive for your church because the resulting turnover drains time and resources searching for replacements and training them. According to the Saratoga Institute, the cost of finding a new hire can amount to one to three times the former employee’s compensation. On the other hand, if your church overpays employees, the church’s budget suffers. It can also lead to legal issues, including “intermediate sanctions.”

Compensation surveys typically contain data about wages, incentives, variable pay, and often healthcare and benefits information, such as paid time off, sick leave, flexible work schedules, and other operational and administrative types of information.

Surveys typically compare jobs and employee wages and benefits by church, company, or organization size, according to job descriptions and position levels (entry, intermediate, and senior), and wages and total cash compensation paid in different geographic locations. They also contain valuable information that can be used for building compensation structures, to determine the organization’s competitive position in the local community, and to determine whether current church employees are receiving fair, reasonable, and competitive wages. Salary survey data can also be used by church leadership to plan for growth and for recruiting new, high-performing talent.

Here are the benefits of purchasing and utilizing a good compensation survey:

- The assortment of data can be useful to your church leadership in discerning fair, equitable, and reasonable compensation packages for church employees.

- Data for jobs/positions found with similarly situated employers include same size, location or region, revenues/budget size, and education and experience. Such compensation data can aid in benchmarking and in establishing a compensation plan specific for the positions held in your church.

- Periodic reviews of your church’s current compensation plans can be helped by benchmarking jobs and comparing the latest survey information to your church’s jobs and compensation structure.

- Standard, proven methods of data gathering and statistical analysis are used to determine how much other churches, nonprofits, or for-profits pay for a specific job. A number of organizations conduct salary surveys, including human resource and compensation survey businesses, compensation consulting firms, industry associations, educational institutions, state and federal governments, and custom-generated surveys.

- Respondents’ personal information is protected—information isn’t affiliated with a name—and raw data on any one job/position isn’t shared in order to protect the church from any potential legal entanglements.

However, before relying on salary surveys, church leaders need to understand the strengths as well as potential weaknesses of the surveys they consider using. Here are some cautions and concerns to note:

However, before relying on salary surveys, church leaders need to understand the strengths as well as potential weaknesses of the surveys they consider using. Here are some cautions and concerns to note:

- Consider the time it will take staff to research and evaluate valid and reliable surveys that can be used by your church.

- If participating, a lot of time and effort is needed from a trained staff member to fill out the survey correctly.

- After purchasing a survey, a church will need to put much effort into collecting its own data for making proper comparisons and determining benchmarks. There is also the problem of properly interpreting and applying survey data—which can be a significant problem for small staffs with little experience in reading and interpreting survey data.

- Compensation survey report data is often collected for a specific time frame and may become dated quickly. Therefore, it is important to choose a compensation survey that’s relatively new so as to ensure its relevancy. (Because of the time-sensitive information, surveys are often identified by the month, quarter, or year in which the data was collected.)

- Don’t immediately trust salary survey information—especially if you stumbled upon it during an online search. Surveys should be developed by a recognized professional HR resource or a compensation resource known for accurate and valid salary and benefits data. If that’s not the case, don’t trust it.

- Participating in a salary survey means an organization provides its confidential wage data to an entity that compiles and analyzes the data. However, sometimes it is not always clear who the other participating organizations are who are providing wage and salary information as well. Without this knowledge, a lot of time and effort could be wasted by participating in a survey that is not relevant to your church’s needs.

To ensure valid and accurate results, use at least two or more compensation survey data sources when comparing your jobs and setting your compensation structure. ChurchSalary.com, published by Christianity Today, is one viable option because it combines data collected for 18 different positions from churches nationwide and also incorporates information related to cost of living as well as comparisons with comparable roles from the for-profit and non-profit sectors.

Other potential survey sources include:

- US Department of Labor’s Bureau of Labor Statistics;

- State Occupational Employment and Wage Estimates;

- Local chambers of commerce;

- Society for Human Resources Management (SHRM);

- WorldatWork;

- Local association surveys;

- Local area job placement firms;

- Temporary employment agency job data; and

- National and regional for-profit and not-for-profit surveys published by research or consulting firms.

Use survey data

Some of the data analytics and information found on ChurchSalary.com are listed below. Consider these when using survey data to assess and set church staff compensation.

• Church annual income:

- $50,000 or under

- $50,001-$100,000

- $100,001-$250,000

- $250,001-$500,000

- $500,001-$750,000

- $750,001-$1,000,000

- $1,000,001-$2,000,000

- $2,000,001-$3,000,000

- $3,000,001-$5,000,000

- $5,000,001 or more

• Worship attendance:

- 50 or less

- 51-100

- 101-200

- 201-300

- 301-500

- 501-750

- 751-1,000

- 1,001-2,000

- 2,001-3,000

- 3,001 or more

• Education attained and years employed/experience;

• Geographic location;

• Church settings:

- Metropolitan city

- Suburb of large city

- Small town or rural city

- Farming area

- Region

• Gender: male and female (note possible pay inequalities here)

Review job descriptions

Next, a thorough review of job descriptions—through what is called a job analysis—will help further establish your church’s baseline. A job description describes the essential functions of a job, minimum educational and experience requirements, as well as the frequency and importance of all tasks and responsibilities associated with a particular job. The job analysis gathers, documents, and analyzes this information. From there, all job descriptions should be updated to accurately reflect the work involved for each role.

This step will ensure that job descriptions accurately reflect the work done by each person and compensation is appropriately set. This will also help compare the data obtained from salary surveys to the roles your church employs. In other words, it’s important to compare apples to apples as much as possible. (How to use salary surveys to compare your own compensation packages with other churches is handled in the next section.)

Set benchmarks and ranges

Using the salary data you’ve gathered, start matching your job descriptions to descriptions in the surveys used, rather than the job titles. The reason for doing this is that not all surveys are structured the same and will use different names for the same jobs. For example, an administrative assistant in one survey could be described as a high-level secretarial position, but in another survey, an administrative assistant could be described as an entry-level professional position with a degree that performs high-level administrative work.

Next, look for key data points regarding salary plus benefits data for each role so that benchmarks can be set.

Below are compensation components you might use for comparison and benchmarking.

• Cash compensation

- Base pay/salary

- Bonus/incentive

- Cash gifts/love offerings

- Housing/parsonage allowance—allowable expenses

- Other cash (overtime) and cash equivalents (entertainment/professional sports tickets, cash cards to restaurants or stores, cash value gift certificates)

• Cost of benefits

- Health insurance

- Life insurance, AD&D

- Disability insurance

- Paid time off (PTO)

- Self-employment tax

- Savings/retirement

- Education assistance/tuition reimbursement

- Automobile allowance/cost reimbursement

- Other: cell phone, computer, school fees for children

- Meals

- Social or health clubs

• Other compensation

- Equity allowance

- Home loans/home sales to ministers

- Salary reduction plans

- Relocation assistance

- Payment for intellectual property or works made for hire

- Retirement

- Severance payments

Use market data points

With survey data in hand, it’s time to create a market composite for each of your benchmark positions and then develop a strategic, market-based compensation structure. One recommended practice is to combine similar data points from several surveys either by simple average, employee-weighted (or organization-weighted) data in order to develop a composite market data set for your church. Most surveys report 25th, average, 50th, and 75th percentile data points for base salary, bonus targets, actual bonus payouts, and total cash compensation.

Averaging the individual 25th, average, 50th, and 75th percentile data points from each survey creates a market composite value. HR staff or administrative/operational professionals should use judgment in reviewing this data to determine the best approach for using it in developing your church’s compensation plan and structure. There is no right answer, but with consistency, the results will most often be internally accurate.

TIP Review your current pay rates against the market data points found in reliable survey sources. The game plan should be to review each of your benchmark’s current employee average pay rates against the 25th, average, 50th, and 75th percentile data points found in many surveys. Be sure your benchmark job descriptions match accurately to the duties and responsibilities found in the survey descriptions.

The composite market data points not only provide the tools necessary to create the pay structures but also allow comparison between the market and a church’s compensation philosophy.

Reviewing the market data can confirm that your church has selected an appropriate compensation philosophy for its talent management needs, strategic plan goals, and fiscal realities. Reviewing with senior leadership the high-level composite market data against the compensation philosophy also affords the opportunity to obtain further buy-in and make any necessary modification to the compensation philosophy.

Develop your pay structure

You and your church human resources personnel, or administrative/operational personnel, can use the composite market data to help you review and compare that data with what you pay for each of your church’s jobs. Based on the results of this exercise, an actual pay structure can be developed for your church by taking this information to construct pay grade, pay range, and job classification structure (i.e., a structure that clearly defines each job according to a carefully crafted job description).

Create your pay grade

By creating pay grades, you are basically using market data to create your internal strategy for grouping your positions together based on the results of similar positions the salary survey data collected. You should note (1) the range of pay found in all salary surveys used; (2) how the jobs that have been grouped together fit from an internal perspective; and (3) all of the information that may be relevant when establishing a salary range for your pay grade. Often, employers want to consider their midpoint of a salary range to be the 50th percentile, the median or mean of the market, if they want their pay grades and associated pay ranges to reflect the market.

To complete the process, employers can group positions having similar market salary ranges and internal positioning together into the same pay grade.

Develop salary ranges

One of the main purposes of gathering and using the external market survey data you have collected is to use this information to develop a competitive internal pay structure for your church through the creation of a strategic pay grade and salary range structure. As mentioned above, by creating pay grades, you are basically using market data to create an internal strategy for grouping your positions together based on the results of the salary survey data collected. As a complement to creating pay grades, salary ranges create a systematic approach to pay employees, help control pay expenses, and help ensure pay equity among jobs and employees. With all the media attention surrounding pay inequality, it has become increasingly important that employers have rational explanations for why they have chosen to pay their employees a certain rate. Salary ranges help an employer do this.

The purpose of this section is to provide a basic formula for creating compensation grades for your church. This formula is intended for general use and should be tailored to meet your specific needs and goals. If you and your staff do not have experience and knowledge of compensation design principles, seek guidance from a compensation expert.

Salary ranges are calculated for each job grade based on findings from your market analysis study and are simply a spread of plus and minus of the target/market pay point or range midpoint. Range maximums set the ceiling for a particular pay grade. Range minimums set the floor. The midpoint corresponds to where the pay line crosses each grade based on the market analysis/study information derived from compensation survey data.

For each pay grade, your church will need to establish a midpoint, a minimum, and a maximum pay range. There really is no hard and fast rule on creating salary ranges. In this example, we will use the midpoint as the base for developing the salary range. Other methods can also be used but will not be covered in this example.

As discussed above, an easy way to come up with a proposed midpoint is to average the market data between the different positions grouped in a grade.

Once this is done, a traditional salary range spread is commonly 40 percent to 50 percent. It is also common that top salary grades (i.e., for church leadership) have a wider range (sometimes in the range of 60 or 70 percent).

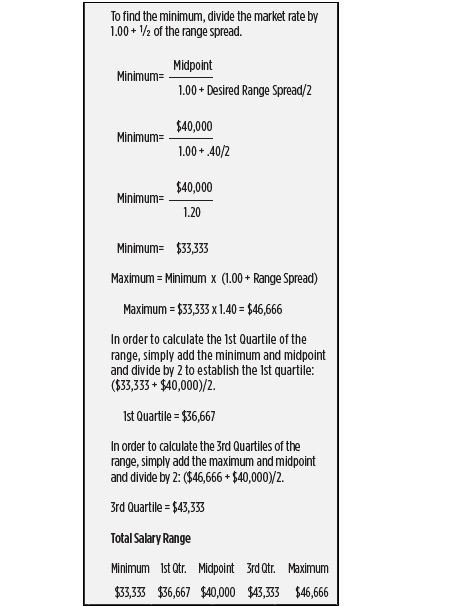

To flesh out this example, let’s take a look at the formula for a 40-percent range spread using the midpoint of $40,000 as the base:

This formula can be used to establish a salary range for any job based on the midpoint of available salary survey market data.

Evaluate and decide

After calculating salary ranges, you can begin to take a look at what your church is paying your employees in comparison to the ranges it has created for positions in your church. Based on this review, the church may need to make some decisions to ensure that it is paying its employees fairly and equitably.

Concluding thoughts

The art of developing and executing a total compensation strategy and program for your church involves many pieces: assessing culture; shaping policy; understanding costs and the big picture surrounding them; reviewing job descriptions; setting benchmarks and ranges; finding and using survey data; and then setting pay structures, grades, and ranges.

Collaboration among your church’s leaders is a must because putting these pieces together may not always be easy. But it is worthwhile. By building a compensation strategy, your church will be on a path toward executing a fair, reasonable, and equitable approach to compensating its employees. This will build a highly positive work environment for your church. It also will help ensure it operates in a legally compliant manner.

Example: Data Trends for the Senior Pastor Position

ChurchSalary.com offers detailed data for 18 different positions. This type of data will help you make comparisons and then set benchmarks for each similar position you have at your church.

To give you a feel for what’s available on this site, here is a quick (and very condensed) sampling of data for the senior pastor position.

A senior pastor is defined as the lead of a church where there are multiple paid pastoral ministry positions.

- 97 percent of senior pastors surveyed work full-time and 3 percent work part-time.

- 99 percent are ordained.

- 90 percent are employed by the church, and 10 percent are self-employed.

- Compensation for senior pastors trends higher with bigger church budget/income and worship attendance.

- Total compensation for senior pastors in metropolitan areas and large city suburbs typically runs higher than for senior pastors serving in small towns and farming areas. This observation also correlates back to church budget/income and worship attendance.

- The total compensation for senior pastors trends higher according to education: senior pastors with a doctorate earn, on average, 18.6 percent more than those with a master’s; senior pastors with a master’s earn, on average, 19.1 percent more than those with a bachelor’s; senior pastors with a bachelor’s earn, on average, 4.1 percent more than those with less than a bachelor’s.

- Female senior pastors earn more median total compensation dollars than their male counterparts (a 10.13 percent difference), and are nearly equal in average total compensation dollars paid. When it comes to average salary and salary plus benefits, male and female pastors basically are paid the same (a .55 percent difference).

Note: The survey sample size between males and females varied greatly. The female survey population is approximately 340.71 percent below that of the male population. So caution should be used when making comparisons and benchmarks.

Reviewing Your Employment and Compensation Practices

If you’re seriously considering reviewing, updating, and retooling your total compensation, benefits, and rewards programs (i.e. pay, health benefits, paid time off, and many of the other potential items listed as compensation components) there is no better time than the present. It is well worth the effort to spend additional time and resources to objectively evaluate your policies, practices, procedures, and strategies.

Results from this review can provide decision-makers the information necessary to decide which policies, procedures, and areas of the organization need improvements.

And once that process is complete, your church should make it an annual or every-other-year task. Doing so will help ensure you remain legally compliant and strategically current and competitive.

Reviews can be structured to be either comprehensive or specifically focused, within the constraints of time, budgets, and staff. There are several types of reviews and each is designed to accomplish different objectives. Here are the most common types:

Compliance. Focuses on how well the organization is complying with current federal, state, and local laws and regulations. Also focuses on how well the organization is actually following its own workplace, human resource, compensation, benefits, and total rewards policies and procedures in order to identify gaps.

Strategic. Focuses on strengths and weaknesses of systems and processes to determine whether they align with the organization’s strategic plan.

Best workplace and employment practices. Helps the organization maintain or improve its strategies as an employer by comparing its practices with other organizations identified as having exceptional policies and practices.

Function-specific. Focuses on one area (e.g., compensation, performance management, healthcare benefits).

To help you understand why a review is important, I offer answers to two common questions churches ask:

Question: Why should church leadership conduct a policy, procedure, and total compensation review?

Answer: To ensure federal, state, and local regulatory, tax, and legal compliance; internal policy and procedure compliance; and to ensure it passes the smell test for fair, equitable, nondiscriminatory, reasonable, and just-pay and benefits practices. If there are compliance issues, they need to be addressed and a corrective action plan should be put into place to rectify any issues. Better to find internal issues before a regulatory agency or media organization beats you to it.

Question: What might a review reveal?

Answer: Pay inequality/discriminatory practices; noncompliance with federal, state, and local regulatory, tax, and legal requirements; noncompliance with church HR policy and procedures; and so on.

With those two questions answered, your own answers to the following questions might further clarify why your church should carefully consider the value of a review.

- Do you have clearly defined employee classifications (i.e., full-time, part-time, temporary, short-term, exempt, nonexempt, regular employee, independent contractor)?

- Are you paying your exempt and nonexempt employees in compliance with federal and state wage and hour laws?

- Do you have clearly defined paid-time-off policies (vacation, sick, holiday, other)?

- If you offer group health benefits, do you have summary plan descriptions for the required plans?

- Are benefit plans clearly communicated to eligible employees?

- Have you designated a portion of an eligible minister’s compensation as a housing allowance?

- Are you aware that although a properly designated housing allowance is not subject to federal income taxes, it is subject to be included in reasonable compensation as part of total compensation paid?

- Are you aware of the possibility that unreasonably high compensation to any person could result in a loss of your church’s tax-exempt status?

- Are you aware that employees could be subject to an excise tax equal to 25 percent to 200 percent of the amount of excess benefit (the amount by which actual compensation exceeds the fair market value of services rendered)?

- Are you aware that decision-makers could be liable for excessive compensation paid to church staff?

- Are you aware that pay inequality based on gender, race, age, etc., is a discriminatory practice and subject to US Department of Labor investigation?

- Do plans subject to IRS Section 125 (cafeteria plans) meet the design, notification, nondiscrimination, and recordkeeping requirements?

- Do benefit and wellness plans comply with the portability and privacy requirements of the Health Insurance Portability and Accountability Act?