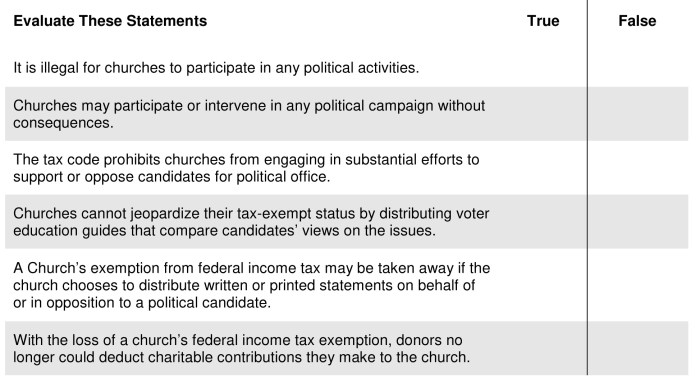

When it comes to political activity, churches need to understand their constitutional protections, as well as the Internal Revenue Code’s restrictions for 501(c)(3) tax-exempt organizations. Take the following quiz to test your knowledge. The answer key is at the end of the article.

Download a PDF version of this assessment.

There are two distinct limitations in the tax code. First, churches may not engage in substantial efforts to influence legislation. Second, churches may not participate or intervene in any political campaign, even to an insubstantial degree. The first limitation is referred to as the “lobbying” limitation. The second limitation is referred to as the “campaign” limitation.

The income tax regulations interpreting the limitation on political campaign intervention provide that neither a church nor any other organization can be exempt from federal income taxation if its charter empowers it “directly or indirectly to participate in, or intervene in (including the publishing or distributing of statements), any political campaign on behalf of or in opposition to any candidate for public office.” The regulations further provide that:

The term “candidate for public office” means an individual who offers himself/herself, or is proposed by others, as a contestant for an elective public office, whether national, state, or local. Activities that constitute participation or intervention include, but are not limited to, the publication or distribution of written or printed statements or the making of oral statements on behalf of or in opposition to such a candidate.

Consequences of Church Political Activity

None of the political activities described above are “illegal.” The primary legal consequence of church political activity is that the church’s exemption from federal income taxation may be jeopardized.

Loss of a church’s federal income tax exemption would have several potential penalties, including the following: (1) the church’s net income would be subject to federal income taxation; (2) the church’s net income would be subject to state income taxation (except in those few states not having an income tax); (3) donors no longer could deduct charitable contributions they make to the church; (4) the church would be ineligible to establish or maintain “403(b)” tax-sheltered annuities; (5) possible loss of property tax exemption under state law; (6) possible loss of sales tax exemption under state law; (7) possible loss of exemption from unemployment tax under state and federal law; (8) loss of preferential mailing rates; (9) a minister’s housing allowance might be affected; (10) the significant protections available to a church under the Church Audit Procedures Act may no longer apply; and (11) the exemption of the church from the ban on religious discrimination under various federal and state civil rights laws may be affected.

These consequences should be considered when deciding whether or not to engage in political activities that may jeopardize the church’s tax-exempt status.

Answer Key: (1) F (2) F (3) F (4) F (5) T (6) T