Update: CARES Act section 1106(i) specifically excludes any amount of PPP loan forgiveness from inclusion in taxable income, including unrelated business taxable income. Accordingly, a church or other nonprofit organization that receives full or partial PPP loan forgiveness is not required to report the loan forgiveness amount as taxable income on Form 990-T.

One of the most valuable features of the CARES Act’s Paycheck Protection Program (PPP) loans is the ability for employers with 500 or fewer employees, including nonprofits and churches, to apply to have its loan forgiven, in full or in part, essentially converting the forgiven portion into a nontaxable grant if certain criteria are met.

On June 5, 2020, President Trump signed the Paycheck Protection Program Flexibility Act of 2020 (PPP Flexibility Act) into law. This new statute amends several key criteria of the CARES Act, including:

- Extending the Covered Period during which forgivable costs must be accumulated from 8 weeks to 24 weeks, while leaving open the option of selecting an 8-week covered period for loans issued before June 5, 2020.

- Increasing the minimum loan maturity period to 5 years for loans issued on or after June 5, 2020, and permitting borrowers who received a loan prior to June 5, 2020, to negotiate a mutually agreeable extension of the maturity date.

- Extending the deferment of loan payments to the date on which the loan forgiveness amount is remitted by the US Small Business Administration (SBA) to the lender or the date that is 10 months after the termination of the Covered Period if a PPP Loan Forgiveness Application is not submitted during this 10-month period.

Since the passage of the PPP Flexibility Act, the SBA has released 4 new interim final rules (IFRs), 2 new versions of the PPP Loan Forgiveness Application, and 1 new FAQ, with more FAQs anticipated. These publications are all available on the SBA’s Paycheck Protection Program webpage.

This article provides a comprehensive look at PPP loan forgiveness, including changes arising from the enactment of the PPP Flexibility Act and subsequent SBA guidance.

Applying for loan forgiveness with your lender

PPP loan forgiveness is accomplished by completing SBA Form 3508 or SBA Form 3508EZ and submitting it to the lender servicing your PPP loan at the time of application. You can also use an equivalent substitute form or application provided by the lender, if available.

Loan forgiveness is determined by reference to several key factors that are discussed in greater detail below, including:

- The Covered Period, including the Alternate Payroll Covered Period

- Payroll costs

- Non-payroll costs, including mortgage interest, rent, and utilities

- The timing of includible payroll and non-payroll costs

- The required percentage of payroll costs

- The salary and wage reduction amount

- The full-time equivalent (FTE) reduction quotient

- The FTE reduction safe harbors

This article will describe each of these factors before discussing the loan forgiveness application process and the two different forms.

The Covered Period

The CARES Act, as originally enacted, created an 8-week (56-day) Covered Period that the SBA determined begins on the date PPP loans are first disbursed to the borrower. The PPP Flexibility Act extended this 8-week period to a new Covered Period of 24 weeks (168 days) that similarly begins on the date PPP loans are first disbursed to the borrower. However, for borrowers whose loan was issued prior to June 5, 2020, the PPP Flexibility Act permits the borrower to elect either the original 8-week Covered Period or the new 24-week Covered Period.

Change in law. The PPP Flexibility Act extends the Covered Period from 8 weeks to 24 weeks. For loans issued prior to June 5, 2020, the borrower may elect to use either period.

The extension of the Covered Period from 8 weeks to 24 weeks will greatly increase the ability of many borrowers to aggregate forgivable costs without scrambling to include amounts for which there is limited guidance.

Alternative Payroll Covered Period

In the Loan Forgiveness IFR, the SBA created an Alternative Payroll Covered Period (APCP) intended to align with a borrower’s payroll cycle. As originally defined, the APCP begins on the first day of the first payroll period that begins after the commencement of the Covered Period and extends 55 days for a total of 56 days (8 weeks). The Amended Loan Forgiveness IFR allows the APCP to also extend 167 days, for a total of 168 days (24 weeks). A borrower with a biweekly or more frequent payroll cycle is permitted to choose the APCP.

Example. Maple Grove Church uses a biweekly payroll schedule (every-other-week). The church’s standard Covered Period begins on June 1, 2020, the date its PPP loan was disbursed. The first day of the church’s first payroll cycle that begins after June 1, 2020, is Sunday, June 7, 2020. Maple Grove Church may elect to use an 8-week APCP that commences on June 7 and ends on Saturday, August 1, 2020 (56 days) or a 24-week APCP that commences on Sunday, June 7, 2020, and ends on Saturday, November 21, 2020.

Can a Covered Period of less than 24 weeks be used?

The Revised Loan Forgiveness IFR provides that a borrower may apply for loan forgiveness before the end of the Covered Period (either the 8-week or 24-week Covered Period) if the borrower has used all of the loan proceeds for which it is requesting forgiveness. However, if the borrower applies for loan forgiveness before the end of the selected Covered Period and has reduced the salary or wage of any worker by more than 25 percent, then the borrower must compute the salary and wage reduction amount based on the full 8- or 24-week Covered Period.

As a practical matter, if a borrower is not eligible for the reduction in level of business operations safe harbor discussed below, it is unlikely it will make sense to file for loan forgiveness before December 31, 2020. Future FAQs published by the SBA may address this question more fully.

Payroll costs

As described in the First Interim Final Rule, qualifying payroll costs consist of a variety of items, including:

- Compensation to employees (whose principal place of residence is the United States) in the form of salary, wages, commissions, or similar compensation;

- Cash tips or the equivalent (based on employer records of past tips or, in the absence of such records, a reasonable, good-faith employer estimate of such tips);

- Payment for vacation, parental, family, medical, or sick leave;

- Allowance for separation or dismissal;

- Payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums, and retirement;

- Payment of state and local taxes assessed on employee compensation; and

- For an independent contractor or sole proprietor who separately applied for a PPP loan, wages, commissions, income, or net earnings from self-employment or similar compensation.

Allowable payroll costs do not include:

- Payments by an employer to independent contractors (in FAQ 15, the SBA made it clear that because independent contractors may apply for their own PPP loan, they are not includible in an employer’s PPP payroll costs for loan application purposes or for the purpose of loan forgiveness);

- Salary and wages paid to an employee in excess of $100,000 computed on an annualized basis;

- Wages paid to employees under the Expanded Family Medical Leave Act and Emergency Paid Sick Leave Acts (both contained within the Families First Coronavirus Response Act (FFCRA)) for which the employer receives the credits provided by the FFCRA;

- The employer’s share of FICA and Medicare taxes; and

- Payroll costs related to employees whose principal place of residence is not in the United States.

A few words of explanation are useful here. In the First Interim Final Rule, the SBA set out a requirement that at least 75 percent of the loan proceeds must be used for payroll costs. In practice, as shown on the original PPP Loan Forgiveness Application, the intent is that at least 75 percent of the costs submitted for forgiveness (i.e., the combined total of payroll and non-payroll costs) must be payroll costs, even if this amount is less than the total of the loan proceeds. The PPP Flexibility Act revised the 75 percent threshold to 60 percent.

Change in law. To achieve 100 percent loan forgiveness, the PPP Flexibility Act reduced the amount that must be expended on payroll costs from 75 percent to 60 percent.

Second, FAQ 32, published on April 24, 2020, clarified that all cash compensation is includible in payroll costs, including a “housing stipend or allowance.” Based on this FAQ, it is clear that a minister’s housing allowance is includible in payroll costs for both the purpose of the PPP loan application and the PPP Loan Forgiveness Application.

Third, the definition of payroll costs for the purpose of applying for a PPP loan is identical to the definition of payroll costs for the purpose of applying for PPP loan forgiveness. While the SBA has not specifically addressed the question of whether payroll costs omitted during the loan application process may nonetheless be included in payroll costs submitted for loan forgiveness, it does not appear that this omission will be a barrier to including such otherwise eligible payroll costs in your church’s loan forgiveness calculation.

Example. If your PPP loan application did not include the minister’s housing allowance, there is nothing (yet) in the PPP Loan Forgiveness Application that would preclude you from including the minister’s housing allowance in the payroll costs submitted for forgiveness.

Fourth, the PPP Loan Forgiveness Application instructions clarify that the exclusion of salary and wages paid in excess of $100,000 on an annualized basis means the maximum amount of salary and wages that can be included for an individual employee for the 8-week Covered Period is $15,385 ($100,000 ÷ 52 × 8 = $15,385). If an employer uses the 24-week Covered Period, the maximum amount of salary and wages that can be included for an individual employee for the 24-week Covered Period is $46,154 ($100,000 ÷ 52 × 24 = $46,154). This limit only applies to salary and wages. It does not apply to an employee’s allocable share of group health care benefits and retirement benefits.

Fifth, in FAQ 16, the SBA clarified that payroll costs begin with gross wages and are not reduced for an employee’s federal income tax withheld or an employee’s share of FICA and Medicare tax (payroll taxes). However, the FAQ makes it clear that the employer share of payroll taxes is not includible in payroll costs.

Sixth, the Loan Forgiveness IFR clarified that bonuses and hazard pay are includible in payroll costs as salary and wages. In addition, wage payments to furloughed employees are includible in payroll costs, even if paid to employees who are not providing services. Note that the $100,000 annualized limit on salary and wages applies to these payments.

Also note that an additional salary or wage payment made during the Covered Period for hours worked during the Covered Period for the purpose of restoring a cut in an employee’s pay rate, or for the purpose of paying an employee for hours they did not work due to a reduction in work hours, should be includible in eligible payroll costs. The basis for this conclusion is that a principal purpose of the PPP loan program is to keep employees employed at their full pay rate for their regularly scheduled number of work hours.

Seventh, the SBA has yet to address the scope of benefits that qualify as group health care coverage. From the quoted text above it is clear this includes employer-paid premiums for group health insurance. It is likely the term includes employer-paid premiums for group vision and dental insurance plans to the extent they are separate policies from a group health insurance plan.

However, it is unclear how employer payments to the following plans are treated:

- Qualified Small Employer Health Reimbursement Arrangements;

- Individual Coverage Health Reimbursement Arrangements;

- Excepted Benefit Health Reimbursement Arrangements; and

- Health Savings Accounts.

Eighth, it is clear that employer costs related to a self-insured health plan are includible. However, the SBA has not provided guidance regarding how these costs are to be computed.

Ninth, it is clear that “state and local taxes assessed on compensation of employees” include state unemployment tax. In the absence of guidance to the contrary, it is likely this provision includes state programs such as California’s Employment Training Tax (ETT). New York’s disability insurance premium may be includible if it is incurred and paid during the Covered Period. However, New York’s paid family benefit amount may be paid by an employer or the employee and it is not clear if it is a tax. Therefore, it is likely not includible. Finally, workers’ compensation insurance is not a tax assessed on employee compensation. Therefore, in the absence of guidance it to the contrary, it is unlikely to be an includible expense.

Tenth, not all employee benefits are includible payroll costs. Employer-paid group term life insurance, disability insurance, gym memberships, and other similar benefits are not includible payroll costs.

Non-payroll costs

The CARES Act specified three different categories of non-payroll costs which may be forgiven:

- Mortgage interest;

- Rent; and

- Utilities

Mortgage interest

The Loan Forgiveness IFR states that mortgage loan interest on any business mortgage obligation—whether for real estate or personal property—is includible so long as the mortgage itself was in place on February 15, 2020. Only interest is includible, not the principal payment portion of a mortgage payment or any prepayment of principal or interest. In addition to interest on real property mortgages, interest on personal property mortgages (e.g., a loan for the purchase of an automobile, office equipment, or manufacturing equipment) is includible. Note that to be eligible for inclusion in forgivable expenditures, the mortgage or other loan must be an obligation of the applicant.

The SBA has yet to release guidance regarding mortgages or construction loans in existence on February 15, 2020, that were subsequently refinanced or converted to permanent mortgages after February 15, 2020.

Rent

Rent is includible so long as the rental agreement was in place on February 15, 2020. This includes rent on real property and rent paid for the rental of equipment. The SBA has yet to provide clarity as to whether payments for certain services billed by a landlord along with rent (e.g., property insurance) and sales tax are includible. Note that to be eligible for inclusion in forgivable expenditures, the lease agreement giving rise to the rent payment must be an obligation of the applicant.

While the SBA has not addressed this specific question, it is our belief that rent must be paid to a third party. It would be an aggressive position to treat an internal allocation that is characterized as “rent” (such as between a church and the church’s preschool program that is not a separate legal entity) as rent for purposes of both a PPP loan application and an application for PPP loan forgiveness.

Utilities

Payments for the following utilities are included in forgivable PPP loan expenses:

- Electricity;

- Gas;

- Water;

- Transportation;

- Telephone (this should include cell phone contracts arranged by your church); and

- Internet service.

The utility service must have been in place on February 15, 2020. The SBA has yet to provide a definition of what is includible in transportation costs. Further, the SBA has not stated whether sewer service, trash collection, cell phone allowances for bring-your-own-device programs, or allowances for home internet service supporting work-from-home environments are allowable expenses.

Payments for church parsonage utilities have not been addressed in specific SBA guidance. It would appear that a reasonable argument could be made that these utilities are either part of the cash compensation paid to a minister (in which case they would count as payroll costs in satisfying the 60 percent payroll cost threshold) or as the payment of utilities on church property.

The timing of includible payroll costs

The Loan Forgiveness IFR states that “[i]n general, payroll costs paid or incurred during the eight consecutive week (56 days) covered period are eligible for forgiveness.” (Emphasis added.) The Revised Loan Forgiveness IFR clarifies that this rule extends to the 24-week Covered Period or, if elected, the 8-week Covered Period. In addition, the instructions to Line 1 of the application state that the applicant should enter “total eligible payroll costs incurred or paid during the Covered Period or the Alternative Payroll Covered Period.” (Emphasis added.)

The Loan Forgiveness IFR further states that “[p]ayroll costs are considered paid on the day that paychecks are distributed or the Borrower originates an ACH credit transaction.” This means that payroll is paid on the date when it is paid to employees and not on the date that funds are remitted to a payroll processing firm. In addition, “[p]ayroll costs are considered incurred on the day that the employee’s pay is earned.” This appears to be a reference to the employee having actually worked on that day. If a borrower pays employees who are not actually performing services (e.g., a borrower continues to pay furloughed employees), then payroll costs are incurred based on the schedule established by the borrower. This will typically be each day the employee would have performed work had the employee not been furloughed or otherwise not called in to perform services.

Based on this explanation of the rule, payroll costs paid during the Covered Period or the APCP are includible, regardless of when the payroll costs are incurred.

Example. Harbor Light Ministries received its PPP loan funds on April 28, 2020. Harbor Light pays its employees semimonthly (twice each month), on the 15th of the month and on the last day of the month. Harbor Light’s April 30 payroll is fully includible in its forgivable payroll costs as payroll costs paid during Harbor Light’s Covered Period, despite the fact that most of the payroll was incurred prior to April 28, 2020.

Example. Castle Heights Youth Services received its PPP loan funds on May 5, 2020. Castle Heights pays its employees biweekly (every-other-week). Castle Heights’ next biweekly payroll after May 5, 2020, was May 8, 2020. Hourly employees paid during this payroll were paid for the biweekly period of April 18, 2020, through May 1, 2020. Salaried employees were paid for the biweekly period of April 25, 2020, through May 8, 2020. The full amount of the May 8, 2020, payroll is includible in Castle Heights’s forgivable payroll costs, notwithstanding the fact that none of the hourly employee payroll costs were incurred during the Covered Period.

The Loan Forgiveness IFR also states that payroll costs incurred during the Covered Period, but not paid until the first regularly scheduled payroll after the Covered Period, are includible.

Example. Harbor Light Ministries received its PPP loan funds on April 28, 2020. Accordingly, the last day of Harbor Light’s 24-week Covered Period is October 12, 2020. Payroll costs incurred between October 1, 2020, and October 12, 2020, are includible as forgivable payroll costs if they are paid with the October 15, 2020, semimonthly payroll.

Example. Castle Heights Youth Services received its PPP loan funds on May 5, 2020. The last day of Castle Heights’s 24-week Covered Period is October 19, 2020. Castle Heights’s first biweekly payroll after October 19, 2020, is payable on October 23, 2020. Hourly employees paid during this payroll will be paid for the bi-weekly period of October 3, 2020, through October 16, 2020. Salaried employees will be paid for the bi-weekly period of October 10, 2020, through October 23, 2020. The full amount of hourly employee payroll costs were incurred on or before October 19 and are therefore includible in forgivable payroll costs. However, with respect to the salaried employees, only the payroll costs incurred between October 10, 2020, and October 19, 2020, and paid on October 23, 2020, are includible in forgivable payroll costs.

The timing of includible non-payroll costs

The Loan Forgiveness IFR states that non-payroll costs are includible in forgivable costs if they are either paid during the Covered Period or incurred during the Covered Period and paid on or before the next regular billing date, even if that date is after the Covered Period. Based on this statement of the rule, non-payroll costs paid during the Covered Period are includible even if incurred before the Covered Period.

Example. Hillcrest Community Church’s 24-week Covered Period begins on June 1, 2020, and ends on November 15, 2020. Hillcrest pays its May, June, July, August, September, and October electricity bills during the Covered Period. Hillcrest pays its November 2020 electricity bill on the next regular billing date, December 10, 2020. Hillcrest can include the full amount of the May through October bills in its forgivable non-payroll costs, notwithstanding the fact that no portion of the May electricity bill was incurred during the Covered Period. The portion of the November bill that covers November 1, 2020, through November 15, 2020, is includible because it was paid on the next regular billing date after the end of the Covered Period.

While the ability to pay on the next regular billing date will assist in some cases, it does not address amounts that are paid in advance. For example, rent is generally paid in advance. As the rule is worded, a tenant that pays a quarterly rent payment in advance on April 1 and whose 8-week Covered Period begins and ends within the second calendar quarter (i.e., April 1–June 30) would not meet the condition of incurring the expense within the Covered Period and paying for those incurred expenses on the next regularly scheduled billing date (i.e., July 1). However, the extension of the Covered Period to 24 weeks means the July 1 and October 1 payments would be includible.

How is the 60-percent payroll cost rule applied?

As previously noted, to help determine the amount of the loan that can be forgiven (and turned into a nontaxable grant), the PPP Flexibility Act reduced the required percentage spent by recipients on payroll costs from 75 percent to 60 percent. The PPP Loan Forgiveness Application mechanically applies this rule at Line 10 by dividing the total payroll costs reported on Line 1 by 0.60 (60 percent). The resulting amount is then compared to (a) the PPP loan amount and (b) the sum of payroll costs (adjusted by the salary/wage reduction amount and headcount reduction factor) and non-payroll costs. The smallest of these three amounts then becomes the loan forgiveness amount.

The bottom line is that a borrower must spend at least 60 percent of its total PPP loan forgiveness includible expenditures on payroll.

Example. Assume the following:

|

PPP loan amount |

$100,000 |

|

Total payroll costs (before adjustments for salary/wage reduction or headcount adjustment factor) |

$57,500 |

|

Dollar amount of salary/wage reduction and headcount adjustment factor |

$10,000 |

|

Non-payroll costs |

$40,000 |

The three amounts to compare are:

|

PPP loan amount |

$100,000 |

|

Total payroll costs ÷ 0.60 |

$95,833 |

|

Total forgivable payroll costs and non-payroll costs less salary/wage reduction and headcount adjustment factor |

$97,500 |

The smallest of the three amounts is $95,833. Therefore, this is the loan forgiveness amount.

Note. It is clear from the Revised Loan Forgiveness IFR and the PPP Loan Forgiveness Application Instructions that a failure to use at least 60 percent of your loan proceeds for payroll costs will not result in the total forfeiture of loan forgiveness. It will only reduce the amount that will be forgiven.

The salary and wage reduction amount

The Salary and Wage Reduction Amount (SWRA) considers whether an employee’s weekly salary or hourly wage during the Covered Period declined by more than 25 percent when compared to the period beginning on January 1, 2020, and ending on March 31, 2020 (the most recent full calendar quarter before the Covered Period).

For the purpose of this computation, exclude any employee who received more than $100,000 in wages or salary on an annualized basis during any pay period in 2019. Since this exclusionary rule applies to wages or salary, it appears that bonuses or other similar supplemental earnings may be excluded when determining the applicability of this rule.

For reference, the table below shows the amount of gross wages or salary that equates to $100,000 on an annualized basis:

|

Pay Period Frequency |

Amount |

|

Monthly |

$8,333.33 |

|

Semimonthly |

$4,166.67 |

|

Biweekly |

$3,846.15 |

|

Weekly |

$1,923.08 |

The SWRA computation first looks at whether an employee’s rate of pay has decreased by more than 25 Percent. If an employee’s rate of pay has changed by more than 25 percent, then the computation converts the amount of the decrease into a dollar amount.

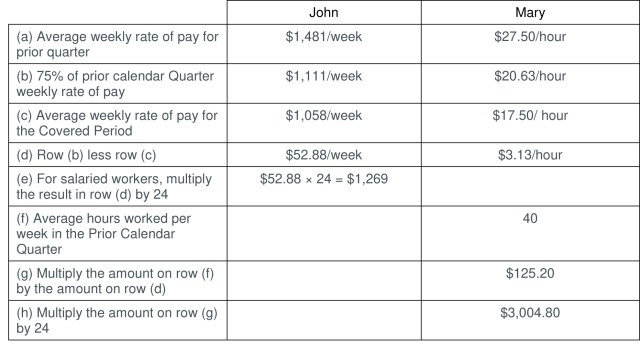

Example. Consider the following employee roster and methods and rates of pay.

Employee

Method of Pay

Average Rate of Pay

|

Covered Period |

Prior Calendar Qtr |

Change in Rate of Pay | ||

|

John |

Salary |

$1,058/week |

$1,481/week |

(28.57%) |

|

Sue |

Salary |

$1,635/week |

$1,731/week |

(5.56% |

|

Ellen |

Salary |

$1,250/week |

$1,250/week |

0.00% |

|

Mary |

Hourly |

$17.50/hour |

$27.50/hour |

(36.36%) |

|

Bill |

Hourly |

$22.00/hour |

$25.00/hour |

(12.00%) |

|

Steve |

Hourly |

$23.00/hour |

$23.00/hour |

0.00% |

In this simple example, Sue, Ellen, Bill, and Steve experienced a decrease in average annual salary or hourly wage of less than 25 percent. Therefore, they do not contribute toward any salary and wage reduction amount. John and Mary, however, each suffered a greater than 25 percent decrease in their salary or hourly wage. Therefore, the next portion of the calculation must be performed.

In conclusion, the total salary reduction amount in this example is $1,269 + $3,005, or $4,274.

Note that the instructions do not provide guidance on the following relevant points:

- How is the average weekly salary or hourly wage computed for an employee who is hired during the first quarter?

- What is the effect on the computation of an employee’s average weekly salary or hourly wage when an employee is hired, furloughed, laid off, or terminated, with or without cause, during the Covered Period?

Change in law. The Revised Loan Forgiveness IFR clarifies that if a borrower does not use the 8-week Covered Period and applies for forgiveness before the end of the 24-week Covered Period, the borrower must account for the salary and wage reduction for the full 24-week Covered Period.

Example. A borrower reduced the weekly salary of an employee from $1,000 per week to $700 per week. Seventy-five percent of the employee’s weekly salary is $750 per week. Subtracting $700 from $750 results in $50. Multiplying $50 by 24 results in a salary and wage reduction amount of $1,200. This amount is used regardless of whether the borrower applies for loan forgiveness before the end of the 24-week period or waits to apply for loan forgiveness until after the conclusion of the 24-week period.

The full-time equivalent reduction quotient

The full-time equivalent reduction quotient (FTERQ) is an adjustment to the loan forgiveness amount. A careful reading of CARES Act section 1106(d)(2)(A) validates that the PPP Loan Forgiveness Application correctly applies the FTERQ to both payroll costs and non-payroll costs. The FTERQ is computed on Schedule A using Lines 11 through 13.

The FTERQ is computed by dividing the total average FTEs during the Covered Period by the total average FTEs during a reference period. The quotient may never be greater than 1.0. A borrower may choose between up to three different reference periods:

- February 15, 2019, to June 30, 2019 (a period of approximately 19 weeks);

- January 1, 2020, to February 29, 2020 (a period of approximately 9 weeks); or

- (For seasonal employers only) any 12-week consecutive period between May 1, 2019, and September 15, 2019.

Example. Assume the following FTE headcounts:

During the Covered Period: 30.2

During the period of February 15, 2019, to June 30, 2019: 29.3

During the period of January 1, 2020, to February 29, 2020: 31.5

Using the February 15, 2019, to June 30, 2019, measurement period, the FTERQ is 30.2 ÷ 29.3 = 1.03, which by rule converts to 1.0.

Using the January 1, 2020, to February 29, 2020, measurement period, FTERQ is 30.2 ÷ 31.5 = 0.9587.

Because you have the choice of measurement periods, you would choose the February 15, 2019, to June 30, 2019, measurement period, as this period results in no reduction in the loan forgiveness amount.

Computing FTEs

The Loan Forgiveness IFR provides the following process for computing FTEs:

- For each employee, determine the number of hours paid each week during the period for which FTEs are being computed.

- For each employee, compute the average number of hours paid per week during the relevant period.

- For each employee, divide the amount from Step 2 by 40, rounding the result to the nearest tenth. The result should not be greater than 1. An employee who works on average more than 40 hours per week can never count as more than one employee.

- Sum the amounts computed in Step 3.

Note that this computation looks at the number of hours for which an employee is paid. Accordingly, in the circumstance where an employee was kept on the payroll but was not performing services, they are included in the FTE computation based on the number of hours the borrower chose to pay them.

The instructions provide a simplified method for completing the FTE calculation. In this version, an employee working at least 40 hours a week counts as 1 FTE, and an employee working less than 40 hours a week counts as 0.5 FTE. If this simplified method is selected, it must be used for all FTE calculations.

If the number of employees in each category has been stable across all time periods, the simplified method should produce a comparable result that will not negatively affect the outcome of the various tests. However, if there is more than an insignificant amount of movement between employees working 40 or more hours per week and employees working fewer than 40 hours a week, you should avoid the simplified method.

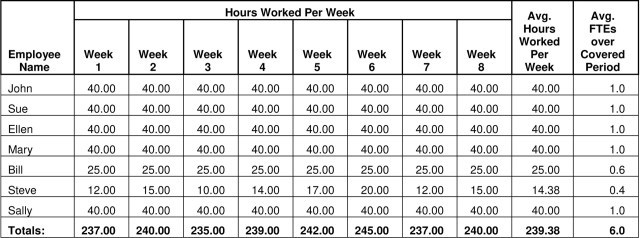

Example. Assume an employer with 7 employees. John, Sue, Ellen, and Sally are salaried employees who each work 40 hours per week. Mary is an hourly employee who works 40 hours a week while Bill and Steve are hourly employees who work less than 40 hours per week. Bill’s hours are steady while Steve’s vary from week to week. During the Covered Period, the hours worked for all 7 employees are as follows:

In this example, there are seven employees, but this converts to six FTEs for the Covered Period.

FTEs may need to be computed for up to five periods:

- The Covered Period or, if elected, the Alternative Payroll Covered Period;

- The reference period selected;

- The payroll period that includes February 15, 2020;

- The period February 15, 2020, through April 26, 2020; and

- June 30, 2020.

These computations may be performed by a payroll service provider.

Full-time equivalent reduction quotient relief in certain cases

The Revised Loan Forgiveness IFR clarifies that an employer can include a terminated employee in its FTE headcount if the employer:

(a) Makes a good-faith written offer to rehire an employee who was employed on February 15, 2020;

(b) Maintains a written record of the employee’s decision to reject the rehire offer;

(c) Informs the applicable state unemployment insurance office of any employee’s rejected rehire offer within 30 days of the employee’s rejection of the offer; and

(d) Maintains a written record of the employer’s inability to hire a similarly qualified individual by December 31, 2020.

Change in law. A version of this exemption was previously published in the Loan Forgiveness IFR. The SBA has determined that the PPP Flexibility Act overrode the original rule. This new rule requires that the employer not only make a good-faith written offer to rehire an employee, but also must maintain a written record of the employer’s efforts to hire a similarly qualified individual. In addition, the employer must report the rejection of an offer to the state unemployment insurance office.

In addition to the statutory exemption permitting the inclusion of certain terminated employees in FTE headcount computation, the instructions provide for FTERQ relief in four additional instances:

- Where an employer makes a good-faith written offer to restore any reduction in hours at the same salary or wages during the Covered Period or the APCP and the employee rejects the offer;

- Where an employee is terminated for cause;

- Where an employee voluntarily resigns (presumably this includes retirement); and

- Where an employee voluntarily requests and receives a reduction in hours.

The nature of the relief is that you are permitted to include these employees in your FTE headcount for the Covered Period. However, if you replace an employee described in items 1 through 4, you are not allowed to include them in this FTE adjustment (because this would mean the position represented by the otherwise excepted employee would be double-counted).

Notably missing from this list is the normal annual temporary cessation of operations by a seasonal employer, preschool, or school.

The full-time equivalent reduction quotient safe harbors

The CARES Act and the PPP Flexibility Act each created a safe harbor from the FTERQ. The CARES Act’s safe harbor relies on the restoration of staffing to the February 15, 2020, level by December 31, 2020. The PPP Flexibility Act’s safe harbor considers the borrower’s ability or inability to maintain its pre-pandemic level of operation in light of various mandates and recommendations of government agencies in response to the pandemic.

This section will examine each safe harbor.

FTE Restoration Safe Harbor

The CARES Act provides a safe harbor for employers who decreased their FTE headcounts at the outset of the COVID-19 pandemic and then restore their headcounts by December 31, 2020. Your church is eligible for this safe harbor if two conditions are met:

- You had a decrease in its FTE headcount during the period of February 15, 2020, through April 26, 2020; and

- Your headcount on December 31, 2020, is greater than—or equal to—your headcount on February 15, 2020.

Change in law. The PPP Flexibility Act changed the date for computing the FTE Restoration Safe Harbor from June 30, 2020, to December 31, 2020.

To calculate your eligibility for the FTE Restoration Safe Harbor, complete the following steps:

Step 1. Compute your FTE headcount for the payroll period that included February 15, 2020.

Step 2. Compute your FTE headcount for the period of February 15, 2020, through April 26, 2020.

Step 3. If your FTE headcount in Step 1 is greater than your FTE headcount in Step 2, then there was a reduction in your FTE headcount and you must demonstrate that you restored your FTE headcount by December 31, 2020, to avoid a reduction in loan forgiveness. Therefore, proceed to Step 4.

Step 4. Compute your FTE headcount at December 31, 2020. If your FTE headcount at December 31, 2020, is greater than—or equal to—your FTE headcount in Step 1, then you are eligible for the FTE Restoration Safe Harbor and your loan forgiveness amount will not be reduced.

Example.

Step 1. Your FTE headcount for the payroll period that includes February 15, 2020, is 30.2.

Step 2. Your FTE headcount for the 10-week period between February 15, 2020, and April 26, 2020, is 27.6.

Step 3. Because your FTE headcount in Step 2, 27.6, is less than your FTE headcount in Step 1, 30.2, you must go to Step 4 and compute your FTE headcount at June 30, 2020.

Step 4. Your FTE headcount at June 30, 2020, is 30.3. Because 30.3 is greater than the Step 1 FTE headcount of 30.2, you are eligible for the FTE Reduction Safe Harbor and your loan forgiveness amount is not reduced.

The reduction in level of business operations safe harbor

The PPP Flexibility Act added a new, more expansive, safe harbor that will provide many organizations with an exemption from the application of the FTERQ. This safe harbor applies when the organization is able to document in good faith that it is unable to return to the same level of business activity that it was operating at before February 15, 2020, due to compliance with requirements or guidance related to the maintenance of standards for sanitation, social distancing, or any other worker- or customer-safety requirement related to COVID-19 published by one of these entities during the period of March 1, 2020, through December 31, 2020:

- The US Secretary of Health and Human Services (HHS);

- The Director of the Centers of Disease Control and Prevention (CDC); or

- The Occupational Safety and Health Administration (OSHA).

In the Revised Loan Forgiveness IFR, the SBA clarified that a triggering event for this safe harbor includes a local government order, pursuant to CDC guidelines, to shut down all nonessential businesses. The SBA has extended this to both a direct reduction in business activity and an indirect reduction in business activity. This seems to clearly imply that even an essential business that remained open in the face of a local government order, but which experienced a decrease in business activity, should be able to take advantage of this safe harbor. Note also that the rule does not specify the degree to which the business activity must have decreased to take advantage of the safe harbor.

To take advantage of the reduction in operating activity safe harbor, your good-faith documentation must include a copy of the applicable government agency requirements or guidance, or both, which will usually be documented in the local government order, and a copy of appropriate financial records showing the decline in activity. These appropriate financial records should demonstrate a decline in persons served, products sold, or other similar business operating activity measures.

Note. If a borrower is eligible for the reduction in operating activity level safe harbor, the requirement to compute FTEs for any period is eliminated.

The Loan Forgiveness Application

As mentioned earlier, the SBA has now provided two different versions of its PPP Loan Forgiveness Application. The applications are available on the Treasury Department PPP Loan webpage. Form 3508EZ is a short-form application that may be used when specific criteria described below are met. Form 3508, PPP Loan Forgiveness Application, is the long-form application and must be used when Form 3508EZ cannot be used. Lenders are permitted to develop their own substitute versions of these forms.

Note. The SBA has published detailed instructions for SBA Form 3508 and SBA Form 3508EZ.

Overview of Form 3508, the PPP Loan Forgiveness Application

The application consists of:

- A core form (PPP Loan Forgiveness Calculation Form) that summarizes the component parts of the forgiveness calculation;

- Certifications;

- A Schedule A that computes the payroll costs net of reductions;

- A Schedule A Worksheet that is used to compute FTEs and the Salary/Wage Reduction amount; and

- A Borrower Demographic Form.

Only the core form and Schedule A are required to be filed. The Borrower Demographic Form is optional and does not appear applicable to nonprofit organizations.

Overview of the EZ PPP Loan Forgiveness Application, Form 3508EZ

The EZ version of the application consists of:

- A simplified core form (PPP Loan Forgiveness Calculation Form) that summarizes the component parts of the forgiveness calculation;

- Certifications; and

- A Borrower Demographic Form.

Eligibility to use Form 3508EZ

Form 3508EZ may be used in three specific situations that are outlined in the Instructions to Form 3508EZ. These situations are discussed below.

Situation 1

In this situation, the borrower is an individual who is:

- Self-employed;

- An independent contractor; or

- A sole proprietor

In addition, the borrower had no employees at the time he or she submitted a PPP loan application and did not include any employee salaries in the computation of average monthly payroll in arriving at his or her PPP loan amount.

Situation 2

In this situation, the borrower must meet two conditions. First, the borrower must not have reduced the wages of any employee by more than 25 percent during the Covered Period or the APCP compared to the first calendar quarter of 2020. For the purpose of this condition, exclude from consideration any employee paid more than an annualized rate of $100,000 during any pay period during 2019.

Second, the borrower must not have reduced the number of employees or the average paid hours of employees between January 1, 2020, and the end of the Covered Period or APCP. For the purpose of this condition, ignore any reductions arising from an inability to rehire individuals who were employees on February 15, 2020, if the borrower was unable to hire similarly qualified employees for unfilled positions on or before December 31, 2020. Also, ignore reductions in an employee’s hours that the borrower offered to restore and the employee refused.

Many borrowers who weathered the Covered Period with minimal or no changes in rates of pay and no changes in staffing will find this situation applicable. In addition, borrowers who were able to rehire or replace staff before the end of the Covered Period may find this situation applicable. However, for borrowers who are relying on the exemption for employees who rejected an offer of reemployment, this situation is unlikely to be applicable.

Situation 3

In this situation, the borrower must meet two conditions. First, the borrower must not have reduced the wages of any employee by more than 25 percent during the Covered Period or the APCP compared to the first calendar quarter of 2020. For the purpose of this condition, exclude from consideration any employee paid more than an annualized rate of $100,000 during any pay period during 2019.

Second, during the Covered Period, the borrower was unable to operate at the same level of business activity as the borrower was able to operate at prior to February 15, 2020, due to its compliance with requirements established or guidance issued between March 1, 2020, and December 31, 2020, by HHS, the DC, or OSHA, related to the maintenance of standards of sanitation, social distancing, or any other worker- or customer-safety requirement related to COVID-19.

This situation has the broadest applicability, as it forgoes any requirement to maintain staffing levels for borrowers who can meet the substantiation requirements of the reduction in level of business operations safe harbor.

Certifications

As with the PPP Loan Application, the PPP Loan Forgiveness Application includes several certifications. Certifications common to both Form 3508 and 3508EZ include:

- That the dollar amount for which loan forgiveness is being requested:

- Was used for eligible expenses;

- Takes into account applicable deductions for any decrease in FTE headcount and/or salary and wage reductions (Form 3508 only);

- Includes payroll costs equal to at least 60 percent of the amount of loan forgiveness requested; and

- In the case of any owner-employee, self-employed individual, or general partner, does not include more than 24 weeks’ worth of 2019 compensation.

- That the applicant understands that the federal government may pursue recovery of loan amounts and/or pursue civil or criminal fraud charges if the applicant knowingly used PPP loan funds for unauthorized purposes.

- That the applicant has accurately verified the payments for the eligible payroll and non-payroll costs for which the applicant is requesting forgiveness.

- That the information contained in the PPP Loan Forgiveness Application and all supporting documentation and forms is true and correct in all material respects. Further, the applicant understands that knowingly making a false statement to obtain forgiveness of a PPP loan is punishable under the law by fines and/or imprisonment. (Depending on the federal statute violated, the fine may range from a fine of not more than $5,000 to a fine of not more than $1 million and the term of imprisonment may range from a term of two years to a term of 30 years).

- That tax documents the applicant submitted to the lender are consistent with those the applicant has or will submit to the Internal Revenue Service (IRS) and/or a state tax or workforce agency. This certification also serves as permission for the lender to share these documents with the SBA.

- That the applicant understands, acknowledges, and agrees that the SBA may request additional information for the purposes of evaluating the applicant’s eligibility for both the PPP loan and for loan forgiveness. Further, a failure to provide additional information requested by the SBA may result in a determination that the applicant was ineligible for the PPP loan or a denial of loan forgiveness.

Form 3508 requires the following additional certifications:

- That the dollar amount for which loan forgiveness is being requested takes into account applicable deductions for any decrease in FTE headcount and/or salary and wage reductions.

- If applicable, that the borrower is eligible for the reduction in level of business operations safe harbor.

Form 3508EZ requires the following additional certifications:

- The applicant did not reduce salaries or hourly wages by more than 25 percent for any employee during the Covered Period or the APCP compared to the period between January 1, 2020, and March 31, 2020. For purposes of this certification, the term “employee” includes only those employees who did not receive, during any single period during 2019, wages or salary at an annualized rate of pay in an amount more than $100,000.

- If applicable, the applicant did not reduce the number of employees between January 1, 2020, and the end of the Covered Period, other than due to an inability to rehire the employees because they rejected an offer of reemployment and the applicant was unable to hire similarly qualified employees by December 31, 2020, and any reductions in employees’ hours that the applicant offered to restore were refused.

- If applicable, that the borrower is eligible for the reduction in level of business operations safe harbor.

There are a few takeaways from reviewing these certifications.

First, the focus is largely on the completeness and accuracy of the information supplied both on the face of the application and in supporting documentation.

Second, while the references to fines and civil or criminal fraud charges should be taken to heart, they are standard terms and should not make an applicant fearful.

Third, while in FAQ 46 the SBA created a safe harbor around the good-faith necessity certification in the PPP loan application for loans with original principal amounts of less than $2 million, the SBA has reserved the right to review loan eligibility in conjunction with the loan forgiveness application for other reasons. Among the eligibility rules the SBA could review during the forgiveness process are:

- Whether the organization receiving a PPP loan had more than 500 employees, or alternatively, more than the number of employees specified in the size standard published by the SBA for the employer’s industry (see 13 C.F.R. 121.201 and FAQ 8 in Frequently Asked Questions for Faith-Based Organizations Participating in the Paycheck Protection Program and the Economic Injury Disaster Loan Program); and

- Whether the organization properly applied the SBA affiliation rules (see the section on Affiliation below).

Review of PPP Loan Forgiveness Applications by the lender

Lenders are the gatekeepers of the PPP Loan Forgiveness Application process. They are charged with reviewing PPP Loan Forgiveness Applications and making the initial determination of a borrower’s eligibility for loan forgiveness. Accordingly, many decisions regarding the application of the PPP loan forgiveness guidance will be at the discretion of lenders.

The Revised Loan Forgiveness IFR requires that a lender’s review of the loan forgiveness application include the following steps:

- Confirmation that the borrower has completed the required certifications in the loan forgiveness application;

- Confirmation that the borrower has supplied all required documentation specified in the loan forgiveness application instructions that is needed to aid in verifying the borrower’s payroll and non-payroll costs;

- Confirmation of the borrower’s calculations on the loan forgiveness application, including the computation of cash compensation, noncash compensation, and compensation to owners as shown on Schedule A of the loan forgiveness application and non-payroll costs shown on the face of the loan forgiveness application; and

- Confirmation that the borrower correctly performed the division of payroll costs shown on Line 1 of the loan forgiveness application by 60 percent, as required on Line 10 of the loan forgiveness application.

If the borrower submits the EZ version of the loan forgiveness calculation, these steps are simply adjusted to reflect the different layout of the form.

The Revised Loan Forgiveness IFR clearly states that the accurate calculation of the loan forgiveness amount is the responsibility of the borrower and not the lender. Further, the borrower must attest to the accuracy of the information presented and the calculations shown on the loan forgiveness application. However, lenders are responsible for performing a good-faith review, in a reasonable time, of the borrower’s calculations and the supporting documentation presented. The lender is permitted to perform a minimal review of calculations based on a report prepared by a recognized third-party payroll provider.

While an application should not be accepted by a lender if it contains calculation errors or there is a material lack of substantiation in the submitted supporting documentation, lenders are encouraged to work with borrowers to resolve these deficiencies rather than simply deny forgiveness, in full or in part. Moreover, a lender is permitted to accept the borrower’s attestation, without further independent verification, that the borrower accurately verified the payments for eligible costs.

A lender is permitted 60 days after the receipt of a completed loan forgiveness application to render a decision as to the borrower’s eligibility for full or partial loan forgiveness. This decision is issued to the SBA. When issuing its decision, the lender must forward to the SBA the borrower’s completed loan forgiveness application; however, it does not appear the supporting documentation is forwarded.

If the lender denies any loan forgiveness, a procedure exists for the borrower to appeal this decision.

Other application matters

What about Economic Injury Disaster Loan advances?

The CARES Act specifies that the PPP loan forgiveness amount is reduced by any amount of an Economic Injury Disaster Loan (EIDL) advance a borrower receives. The PPP Loan Forgiveness Application addresses this by capturing the amount of the EIDL advance and the EIDL application number assigned when the advance was obtained. But the instructions then include this cryptic statement, “If applicable, SBA will deduct EIDL Advance Amounts from the forgiveness amount remitted to the Lender.” Accordingly, if you enter an EIDL advance amount on your loan application, expect that the actual amount of your loan forgiveness will be reduced by the amount of your EIDL advance.

What happens if a PPP loan is not fully forgiven?

There are three options if a PPP loan is not fully forgiven. First, the borrower may appeal the lender’s denial of full forgiveness to the SBA. Second, the borrower can choose to repay the unforgiven part in full. There is no prepayment penalty, although interest will be due at the annualized rate of 1 percent on the unforgiven balance from the date the loan disbursed until the date the unforgiven portion of the loan is paid. Contact the lender servicing the loan for a loan payoff amount. Third, the borrower can choose to pay the unforgiven portion back over the remaining life of the loan.

Required documentation

The instructions to the PPP Loan Forgiveness Application include a detailed list of documentation that should be gathered in support of the PPP loan forgiveness application. The instructions clarify documentation that must be submitted with the loan application, along with documentation that should be maintained by the applicant but is not required to be submitted. Significantly, applicants are instructed to maintain this documentation for a period of “six years after the date the loan is forgiven or repaid in full.” In addition, the documents are to be made available upon request to an authorized SBA representative or a representative of the SBA’s Office of Inspector General.

Affiliate relationships

The application requires organizations that, together with their affiliates, received PPP loans in the aggregate with an original principal balance of more than $2 million to check a box. Presumably this means that an affiliate whose own original principal balance is less than $2 million must check this box if it is a member of an affiliate group that borrowed more than $2 million in the aggregate.

Note that in its Second Interim Final Rule (second IFR), published in the Federal Register on April 15, 2020, the SBA addressed the application of the affiliation rules to faith-based organizations. The SBA acknowledged “that the organizational structure of faith-based entities may itself be a matter of significant religious concern” and that US Supreme Court precedents guarantee to faith-based organizations “the ‘power to decide for themselves, free from state interference, matters of church government as well as those of faith and doctrine’” (citing Kedroff v. St. Nicholas Cathedral of Russian Orthodox Church in N. Am., 344 U.S. 94, 116 (1952)).

In addition, the Religious Freedom Restoration Act, together with Supreme Court precedents, prevent the government from substantially burdening the exercise of religion without a compelling governmental interest. The SBA has determined that applying the SBA affiliation rules to faith-based organizations would impose a substantial burden without a compelling governmental interest.

For this reason, the affiliation rules:

. . . do not apply to the relationship of any church, convention or association of churches, or other faith-based organization or entity to any other person, group, organization, or entity that is based on a sincere religious teaching or belief or otherwise constitutes a part of the exercise of religion. This includes any relationship to a parent or subsidiary and other applicable aspects of organizational structure or form.

However, to avoid the application of the affiliation rules, a faith-based borrower must make a “reasonable, good-faith interpretation” that the affiliation rules should not apply to a given relationship because the relationship is “based on a sincere religious teaching or belief” or in some manner “constitutes a part of the exercise of religion.” The application of this standard to a church, or an association or convention of churches or their integrated auxiliaries, is likely to be more straightforward than its application to parachurch ministries.

Other PPP Flexibility Act changes

In addition to the changes previously discussed, the PPP Flexibility Act changed the minimum loan maturity and the duration of loan deferral.

Minimum loan maturity

The CARES Act specified a maximum loan maturity of not more than 10 years. In its First Interim Rule, the SBA announced a loan maturity of two years would apply to each PPP loan. The PPP Flexibility Act sets the minimum loan maturity of PPP loans issued after June 5, 2020, to five years. In addition, the PPP Flexibility Act explicitly allows for borrowers and lenders to renegotiate the loan maturity of loans issued prior to June 5, 2020.

PPP loan deferral

The CARES Act specified a loan deferral period of not less than six months and not more than one year. Exercising its regulatory discretion, the SBA determined that a deferral period of six months would apply to each PPP loan. During this deferral period, payments of principal, interest, and fees would be deferred. However, interest would accrue pending loan forgiveness.

The PPP Flexibility Act statutorily changed termination of the loan deferral period to the date on which the loan forgiveness amount is remitted to the lender by the SBA. However, the PPP Flexibility Act requires that if a borrower fails to submit a PPP Loan Forgiveness Application within 10 months after the end of the Covered Period, the borrower must begin to make loan payments.

Ted R. Batson Jr. is a CPA and tax attorney, and serves as a partner and Professional Practice Leader – Tax for CapinCrouse LLP, a national CPA and consulting firm. He speaks and teaches frequently for national conferences and organizations on exempt organization and charitable giving matters. He is an advisor at large for Church Law & Tax.

Brent Baumann is a Senior Manager in CapinCrouse’s Denver office, where he works with audit, accounting, and advisory clients. He has over 15 years of experience providing services and expertise to financial statement, internal control, internal audit, and information technology audit and advisory clients.