Since the early 1980s, attorney and CPA Richard Hammar, the cofounder and senior editor of Church Law & Tax, has read thousands of cases involving churches, religious organizations, and educational institutions.

When he does, he determines the relevance of the cases to local congregations. Many of these court decisions become the basis of articles and Legal Developments he writes for church leaders. Along with this work, he has also carefully categorized all of the court decisions—whether he writes about them or not—primarily in an effort to discern broader unfolding legal trends affecting churches.

Identifying these patterns provides a powerful point of information: by categorizing the top legal threats and then publishing about them in an understandable way, Hammar believes church leaders are better equipped to talk about potential challenges they face and how they can take action.

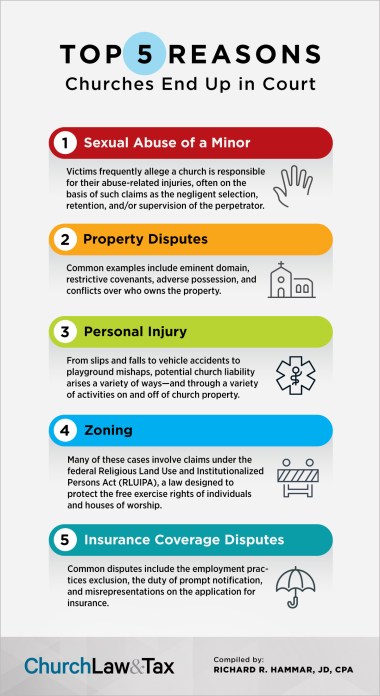

Through this long-standing work, it is now possible to authoritatively identify the Top 5 legal issues most likely to generate litigation targeting churches and religious organizations.

The infographic included with this article summarizes the Top 5, based on Hammar’s many years of research, providing a quick, user-friendly way to help leaders understand the trends, discuss them with staff and board members, and prioritize the efforts necessary to minimize potential pitfalls. (Download a PDF of the infographic to share with your team.)

Fortunately, church leaders can take an active role to minimize potential problems and decrease the chances of ending up in court.

One good first step is to read the articles and collections of articles listed with the Top 5 reasons described below. Another good step is to share this infographic with fellow leaders and use it as a launching point for discussions and planning.

Make child safety a priority

More than 25 years ago, Hammar was one of the first people in the country to address the growing threat of child abuse in churches. Regrettably, the threat has been—and remains—the number one reason churches end up in court each year. In response, Hammar developed Reducing the Risk: A Child Sexual Abuse Awareness Training Program.

Along with Reducing the Risk, any church of any size can get a comprehensive view of the problem, and the solutions needed to combat it, through Hammar’s 14-step plan outlined in his article “Minimizing the Risks of Child Molestation in Churches.”

For additional reading, check out this article collection. Plus, ChurchLawAndTax.com offers the exclusive resource 50-State Child Abuse Reporting Laws Survey for Clergy and Church Leaders, which features a full review of each state’s legal requirements and processes for reporting actual and suspected cases of abuse.

Know who owns the church’s property—and what can be done with it

Property disputes often lead to litigation, whether between a church and a denomination, a church and a municipality, a church and a private party—or even a church and its own congregants. These conflicts most often involve disputes over ownership, covenants, eminent domain, or adverse possession.

Chapter 7 of Hammar’s Pastor, Church, & Law offers insights into these types of property disputes and how courts have responded over the years.

Dealing with everyday dangers

Personal injuries are another common source of litigation for churches each year. A case is usually brought by a person who alleges that he or she was injured either while visiting church property, participating in a church-sanctioned activity, or both. Common examples of claims include unsafe conditions on church property, the negligent operation of a vehicle in the course of church business, or the inadequate supervision of a church activity that results in an injury.

The injured party brings a lawsuit in the civil courts. The party must prove several elements in order to win, but the legal standard required for a party to prevail is not as difficult as the one used in criminal trials. This makes personal injury cases a particular source of trouble for churches.

Generally speaking, even if a church is found liable in a personal injury case, board members and staff members are not also personally liable. However, personal liability can arise under certain circumstances. Chapter 6 of Hammar’s Pastor, Church & Law further explains personal injuries and the potential resulting liability for a church, its board members, and its staff members.

Don’t get zoned out

Municipalities, such as cities, towns, and counties, are authorized by their state governments to set zoning laws that dictate the types of buildings (and building uses) allowed in specific geographic areas. Disputes involving churches frequently arise in two ways: one, when a church located in a residential area conducts activities potentially in conflict with neighboring homeowners; or two, when churches wish to occupy or construct a building in a commercial zone that the municipality prefers to preserve for a business and the tax-generating activities it produces.

The First Amendment of the US Constitution and similar provisions in state constitutions provide protections for churches when these types of conflicts arise. Similarly, the Religious Land Use and Institutionalized Persons Act (RLUIPA) offers additional protections. Hammar explains these protections further in the zoning law section of Pastor, Church & Law’s Chapter 7.

Know what’s covered by insurance—and how

Disputes between churches and insurance companies most commonly develop in one of two ways.

One way is coverage exclusions. A coverage exclusion is a loss not covered under a general liability policy. Often, additional special coverage must be obtained in advance by a church in order for a future claim to be covered by the insurer. One common issue that is not typically covered in a general liability policy is a claim alleging sexual misconduct by a church employee or volunteer.

The other way is the duty to notify. Insurance policies typically contain strict language regarding how quickly a church must notify the insurer of a possible claim, and when a church fails to do so within the prescribed timetable, the insurer can reject the claim. Leaders must read the fine print of their policies, and also should consult with their insurance agent or broker to make certain they understand deadlines for notifying (as well as the types of situations that start the clock for those deadlines).

Check out this quick overview of the types of insurance a church should consider with action items you can take today.