Loading the player…

Asked, Answered: The Clergy Allowance and Part-Time Ministers

Do part-time ministers qualify for the clergy housing allowance? Matt Branaugh helps you answer hat critical question.

Advantage Member Exclusive

Advantage Member Exclusive

On-Demand Webinar

Advantage Member Exclusive

Advantage Member Exclusive

On-Demand Webinar

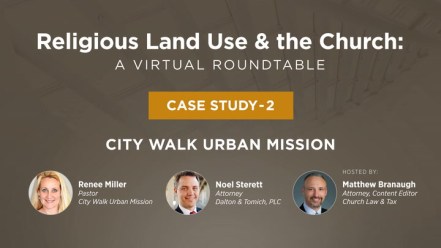

A VIRTUAL ROUNDTABLE

On-Demand Webinar

Advantage Member Exclusive

Advantage Member Exclusive

On-Demand Webinar

Advantage Member Exclusive

On-Demand Webinar

On-Demand Webinar

Advantage Member Exclusive

Advantage Member Exclusive

Advantage Member Exclusive