Reporting financial crime is a matter of stewardship, yet nearly 70 percent of churches that have experienced fraud chose not to report it to the police, according to a 2021 survey of more than 700 church leaders.

Included in This Series

The spring 2021 study on financial misconduct surveyed 706 church leaders.

About one-third of leaders said financial misconduct had taken place in their churches. Among those churches that experienced fraud, only a third filed a report with law enforcement.

In my own experience, the vast majority of churches that know or believe financial misconduct occurred are reluctant to contact law enforcement.

These leaders told me they would rather handle the matter internally. Church Law & Tax’s nationwide survey confirms this.

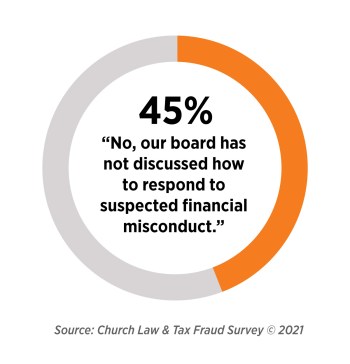

Additionally, nearly half of the respondents said their church boards have not discussed how they would respond to suspected fraud.

Why leaders do not report financial crimes

In the survey, leaders most frequently gave these explanations as to why they did not contact authorities:

- We were able to recover the money without having to take legal action (27.7 percent).

- We wanted to work on restoration with the individual(s) (26.5 percent).

- We did not want to make it public to protect the church’s reputation (20.5 percent).

- The church chose to forgive rather than report to the authorities (19.3 percent).

- We did not want to make it public to protect the individual(s) (16.9 percent).

- Legal action would go against the church’s ministry philosophy (7.2 percent).

(Note: Respondents were asked to check all that apply.)

When I speak with church leaders, their hesitations for contacting law enforcement often arise because the suspected embezzler is almost always a trusted member or employee, and church leaders are reluctant to accuse such a person without irrefutable evidence of guilt.

Seldom does such evidence exist. The pastor may confront the person about the suspicion, but the individual will often deny any wrongdoing—even if guilty. This only increases the frustration of church officials who do not know how to proceed.

Thinking of not reporting a financial crime?

Caution 1: The fraud is often far greater than the church realizes. A failure to report a financial crime may hide the true depth and extent of the crime committed. CPA Vonna Laue’s experience certainly affirms this. “Each time I have been brought into a ministry’s financial fraud situation, the amount of loss grew as more information was uncovered,” said Laue, a Church Law & Tax senior editorial advisor who advised this nationwide survey project. “It was always more than the perpetrator indicated and sometimes even they were surprised by the total.”

Caution 2: It does not matter whether the embezzler intended to pay back the embezzled funds someday. This intent in no way justifies or excuses the crime. The crime is complete when the funds are converted to one’s own use—whether or not there was an intent to pay them back.

Of course, an offender’s repayment may make it less likely that a prosecutor will prosecute the case. And even if the embezzler is prosecuted, this evidence may lessen the punishment. But the courts have consistently ruled that an actual return of embezzled property does not purge the offense of its criminal nature or absolve the embezzler from punishment for his or her wrongdoing. Also, note that church officials seldom know if all embezzled funds are being returned. They are relying almost entirely on the word of the thief.

Caution 3: Whether a church opts to notify law enforcement or not, there are tax law obligations with the Internal Revenue Service (IRS) that must be fulfilled.

Responding to suspected cases of fraud

Church leaders often learn of suspected financial misconduct because discrepancies or irregularities arise or someone submits a tip.

Top Six Red Flags

The survey indentified these signs that someone might be committing fraud:

1. Excessive control or unwillingness to have others cover his/her job duties

2. Repeated lying/deception

3. Family problems

4. Living beyond his/her means

5. Other moral or spiritual failures.

6. High levels of debt (e.g., credit card, student loans)

Along with these red flags, consider the following scenarios that point to the possibility that fraud might be taking place:

- Giving is always higher when the person who usually does the counting is on vacation or ill during a weekend service.

- A church bookkeeper lives a higher standard of living than is realistic given her or her income.

- Church offerings have remained constant, or increased slightly, despite that attendance has steadily increased.

- A church official with sole signature authority on the church checking account has purchased a number of expensive items from unknown companies without any documentation to prove what was purchased and why.

Safeguarding Your Church’s Finances—a multi-session video course for pastors, board members, staff, and volunteers on the basics of fraud prevention. LEARN MORE!

When unusual activity gets detected, or a tip is received, church leaders should take these steps in response:

1. Carefully gather information before reporting a financial crime

When evidence of actual or suspected financial misconduct surfaces, the pastor and/or church leaders should gather as much information as possible. Compile all documents and records that point to the possible irregularities and inconsistencies. The church should contact its attorney. It also should strongly consider hiring a qualified CPA firm or Certified Fraud Examiner (CFE) to conduct a more thorough investigation.

Note. Some churches have used CFEs to detect embezzlement and estimate the amount of loss. But note that CFEs are not required to be CPAs, and many have far less familiarity with accounting records than a CPA. The ideal professional would be a CPA who is also a CFE. For more information on CFEs, and to find one nearby, go to the website of the Association of Certified Fraud Examiners.

A deeper investigation offers the best way to quickly determine if the irregularities and inconsistencies are a product of human error or misconduct, and the amounts of money lost. If the cause is error, then the church can address the problem while avoiding making any erroneous and harmful accusations. If the cause is misconduct, then the church knows it must take appropriate next steps in whether to report a financial crime.

2. Sit down with the suspected perpetrator

If sufficient information points to a suspected perpetrator, at least two church leaders, and possibly the church’s attorney and the CPA or CFE (if one is hired) should meet with the person. Provide some general descriptions about the irregularities or inconsistencies that have arisen and ask the person what they can tell you about them. Take careful notes, including any questions or comments the person makes.

If the person confesses and asks how things will be handled, explain the criminal nature of the offense. Also explain the legal requirements to contact the IRS (see more below).

Caution. Always keep in mind that embezzlement is a criminal offense. Depending on the amount of funds or property taken, it may be a felony that can result in a sentence in the state penitentiary.

If the person confesses, evaluate with the church’s attorney the possible ways the person can possibly repay the stolen funds—but know that such a step does not absolve the person of his or her crime, nor does it eliminate potential consequences with the IRS. Also know upfront that such agreements by embezzlers to repay funds often are not honored.

3. Contact authorities

If there is a confession, or if the evidence clearly indicates the person stole church funds, church leaders must consider turning the matter over to the police or local prosecutor and the IRS. These are very difficult decisions, since doing them may result in the prosecution, penalization, and possible incarceration of a member of the congregation.

Note. Embezzlers never report their illegally obtained “income” on their tax returns. Nor do they suspect that failure to do so may subject them to criminal tax evasion charges. In fact, in some cases. it is actually more likely that the IRS will prosecute the embezzler for tax evasion than the local prosecutor will prosecute for the crime of embezzlement. Along with contacting local authorities, your church also should contact the IRS regarding the matter.

Before you “forgive and forget”

In some cases, a person confesses to the misconduct. Often, this is to prevent the church from turning the case over to the police or the IRS. Perpetrators believe they will receive “better treatment” from their own church than from the government. In many cases, they are correct.

Lead Your Church With Confidence—Become a Church Law & Tax Member Today.

It often is astonishing how quickly church members will rally in support of the embezzler once he or she confesses—no matter how much money was stolen from the church. This is especially true when the perpetrator used the stolen funds for a “noble” purpose, such as medical bills for a sick child.

Many church members demand forgiveness for the perpeator. The idea of turning the perpetrator over to the authorities is both shocking and repulsive. But is it this simple? Should church leaders join in the outpouring of sympathy? If the embezzler confesses, should church leaders leave it at that?

These are questions that each church will have to answer for itself, depending on the circumstances of each case.

Before forgiving the embezzler and dropping the matter, though, church leaders should consider the following.

Embezzlement is a crime breaches a sacred trust

The church should insist, at a minimum, that the embezzler must:

- disclose how much money was embezzled,

- make full restitution by paying back all embezzled funds within a specified period of time, and

- immediately and permanently be removed from any position within the church involving access to church funds.

Closely scrutinize and question the amount of funds the embezzler claims to have taken. Remember, you are relying on the word of an admitted thief. That is why it is important to involve the church’s attorney, as well as a CPA or CFE, when suspicions first arise.

The embezzler must return the stolen money within a specific time or sign a promissory note agreeing to pay back the funds within a specific time.

Caution. An attorney should be consulted before the church has any discussions about an agreement with the embezzler about paying back stolen funds.

The church faces tax consequences for not reporting financial crime to IRS

The church needs to tell the embezzler that the stolen money is taxable income. Therefore, failure to agree to either of the above alternatives will force the church to issue him or her a 1099 (or a corrected W-2 if the embezzler is an employee) reporting the embezzled funds as taxable income.

If funds were embezzled in prior years, then the employee will need to file amended tax returns for each of those years to report the illegal income since embezzlement occurs in the year the funds are misappropriated.

Failure to report taxable income will subject the church to a potential penalty (up to $10,000) for aiding and abetting in the substantial understatement of taxable income under section 6701 of the tax code.

Note. If an employer is able to determine the actual amount of embezzled funds as well as the perpetrator’s identity, the full amount may be added to the employee’s W-2, or it can be reported on a Form 1099 as miscellaneous income. But remember, do not use this option unless you are certain that you know the amount that was stolen as well as the thief’s identity.

If the full amount of the embezzlement is not known with certainty, then church leaders have the option of filing a Form 3949-A (“Information Referral”) with the IRS. Form 3949-A is a form that allows employers to report suspected illegal activity, including embezzlement, to the IRS. The IRS will launch an investigation based on the information provided on the Form 3949-A. If the employee in fact has embezzled funds and not reported them as taxable income, the IRS may assess criminal sanctions for failure to report taxable income.

Caution. If the embezzler agrees to pay back the stolen money and does so, does this convert the embezzled funds into a loan, thereby relieving the employee and the church of any obligation to report the funds as taxable income in the year the embezzlement occurred? The answer is no.

Most people who embezzle funds insist that they intended to pay the money back and were simply “borrowing” the funds temporarily. An intent to pay back embezzled funds is not a defense to the crime of embezzlement.

The courts are not persuaded by the claims of embezzlers that they intended to fully pay back the funds they misappropriated. The crime is complete when the embezzler misappropriates the church’s funds to his or her own personal use.

There is yet another problem with attempting to recharacterize embezzled funds as a loan. If the church enters into a loan agreement with the embezzler, this may require congregational approval. Many church bylaws require congregational authorization of any indebtedness, and this would include any attempt to reclassify embezzled funds as a loan. Of course, this would have the collateral consequence of apprising the congregation of what has happened.

Reporting financial crime may be a matter of fiduciary responsibility and good stewardship

Viewing the offender with mercy does not mean forgiving the debt and ignoring the crime. Churches are public charities that exist to serve religious purposes.

Donors give money in support of those purposes.

Forgiving and ignoring embezzlement may not serve those purposes.

The church should care about other churches

As Church Law & Tax’s findings also reveal, the average tenure of embezzlers tended to be less than 10 years, and oftentimes measured less than 5 years.

Letting an offender off the hook and sending them on their way exposes other churches to the same behavior. No record of the offender’s activities will be available—and that means even a church that follows healthy screening and selection steps (including criminal background checks) will be unable to detect this person’s past offenses.

As Laue, the CPA who advised the survey project, also notes: “We have a responsibility to protect Kingdom resources, whether they are ours or someone else’s, and we can’t do that if we don’t take the necessary steps to make others aware of the fraudulent activity.”

The bottom line: Churches should report financial misconduct as an act of stewardship for the global church.

Case Study: A Repeat Embezzler. A church administrator embezzled over $350,000 from his church. He wrote unauthorized checks to himself and others from the church’s accounts, and used the church’s credit card on over 300 occasions to purchase personal items. Police officers were called and he made a full confession.

The church secured a $1 million civil judgment against him. He was prosecuted and convicted on four felony counts including forgery and theft, and he was sentenced to 32 years in prison based on “aggravated circumstances” (the large amount of money that had been stolen, the care and planning that went into the crimes and their concealment, the fact that a great number of checks were stolen and unauthorized credit card charges made, and breach of trust).

Several years earlier, the administrator embezzled a large amount from a prior church employer. However, that church chose not to initiate criminal charges, believing that he had learned his lesson.

This case study is taken from the “Embezzlement” section of the Legal Library.

Answers to other key questions about reporting financial crimes

Find detailed answers to the following questions about embezzlement in the Legal Library:

- How does embezzlement occur?

- How does a pastor handle someone who confesses to embezzlement during a confidential counseling session?

- Can a church require a suspected embezzler to take a polygraph test?

- How can a church avoid making false accusations?

- How should a church discuss embezzlement with the congregation?

And as both the study and my own experience show, a most-troubling aspect of financial misconduct in churches is the unfortunate reality that many pastors and other leaders choose to handle fraud or suspected fraud internally—meaning they avoid involving a CPA or CFE, the IRS, and law enforcement. But the failure to report can be problematic for the reasons I have detailed in this article.

For the sake of practicing good financial stewardship, it is my hope and prayer that churches will carefully consider the advice I offer in this article. Most importantly, my hope is that churches will seek do all they can to prevent financial misconduct from happening in the first place through implementing a system of sound internal control.

Attorney Matthew J. Branaugh, content editor for Church Law & Tax, contributed to this article.