As the congregation and staff of Houston’s First Baptist Church were getting ready to celebrate Thanksgiving in 2017, a storm was brewing that threatened to shatter the holiday mood. Irregularities were noticed in the credit card statements of a popular associate missions minister, speaker, and Bible teacher. The investigation deepened and discovered that this individual had embezzled more than $830,000 in church funds since 2011.

The associate missions minister confessed to church officials, resigned, and was later convicted of embezzlement. He was sentenced to 10 years in prison but has been released on a special probation program for first-time nonviolent offenders.

Houston’s First Baptist is far from alone. Gordon-Conwell Theological Seminary’s Center for the Study of Global Christianity estimates fraud in churches worldwide will grow to $70 billion a year by 2025, according to a 2022 report.

At the 2019 Ultimate Financial & Legal Conference in Arlington, Texas, a panel discussed the theft from Houston’s First Baptist and the overall problem of fraud against churches. The panel included Houston’s First Baptist executive pastor David Self and two experts who assisted in the church’s case—nonprofit attorney Frank Sommerville and certified fraud examiner Charles “Chuck” Cummings.

The following interview is adapted from the panel discussion and from another presentation at the conference by Cummings.

What sparked suspicion that fraud was taking place at Houston’s First Baptist?

Self: One questionable credit card charge required some investigation. Then it was like pulling dirty laundry out of the laundry hamper. Each one led to another.

Sommerville: I was one of the first calls that were made once it was decided something was going on. I called Chuck into the case to assist in finding the fraud. It took three months to figure out some of the things that the associate missions minister was doing. This is not your ordinary case by any means. I’ve heard Chuck say that this person was extremely smart, and no matter what internal controls you had in place, they would not have prevented it. Here’s an example of how smart he was: By forging the supervisor’s initials, he circumvented the internal control that says supervisors approve expense reports

Self: This individual was perceived as a close friend of the senior pastor and of his supervisor. He purported to be everybody’s close friend. When Chuck interviewed the supervisor, he said, “I never authorized any expense he made.” That’s a major circumvention of internal controls. The supervisor was supposed to look over those credit card statements and those requests. But because of their close relationship, the supervisor looked at oversight as a signal that he didn’t trust his friend if he was looking over his friend’s shoulder, and the associate missions minister played upon that.

Our director of operations called me and said, “We have some potential problems with this employee’s credit card.” My first reaction was, “I’m sure there’s an answer because that’s not the person I know.” As it came to light, I had to confess I didn’t know that person. He was totally misrepresenting who he was. By about four or five days of looking into the matter, it was close to Thanksgiving. The senior pastor was away with his family. I did not want to interrupt him until we knew something. But by the Wednesday before Thanksgiving, it had gotten to the point where we had to tell him.

We called the senior pastor, and he said, “I don’t want to know the person. If they’re innocent, I don’t want their name smeared in my mind later on. But I want you to contact their supervisor.” The supervisor and our director of operations sat down and we looked over the credit cards. Then when they had agreed that there was, in fact, a problem, we notified the senior pastor, brought the accused in, and he resigned that day.

How do you feel about that way the church initially handled the situation?

Self: For the first three weeks, our whole emphasis was about restoration. He had a tremendous place of respect within the church. Our whole focus early on was, “You made a mistake, and we’re going to make it right.” What we didn’t understand is that you can’t sin unless you lie. That’s any sin, but especially fraud. There has to be a tremendous amount of deceit and we totally underestimated that early on.

During an interview with a church official, he confessed and resigned. But he only confessed to a small amount. Then he went to other members of the congregation and evidently, according to their testimony, gave them a totally different story: that we had misled him, that he didn’t understand our controls process, that it was less than $10,000, that he was going to write a check, that he was going to pay it back.

We should have never interviewed the suspect. We should have never done anything without legal counsel, but we did.

Before we called Frank, it was a matter of, “Can we handle this internally?” But we found out that there’s a difference between an internal problem and a legal problem. If you had somebody shoot someone in the corridor of your church on Sunday morning, you wouldn’t say, “It happened at a church. We need to forgive him and show grace.” No, that’s a legal issue. That’s what we had. We had to flip that switch and call a lawyer.

What about assembling a response team? Who should be on this team and what should their roles be?

Self: Our senior pastor said, “We want the investigation and the decisions to be made by a lay group.” Since we would be investigating someone on staff—someone who had prominence and seniority—we didn’t think it ought to be an investigation done by the staff.

We assembled our team by office. We had the chairs of the deacons, finance committee, personnel committee, and a former chair of the missions council because that’s where the money was taken from. It’s important to point out that one was an accountant, one was a banker, and one was a lawyer.

Sommerville: The church has to select a small group vested with decision-making authority. They’re the ones who decide who to pursue, how to pursue, and what you’re going to do. They are the decision makers. I gather the facts and present them to this group. They then make decisions. If you have a church that is run by a board, it should be a subcommittee of the board.

A smaller group makes sense for two reasons: First, if it’s a mere misunderstanding, the problem can then be corrected without getting the whole church in an uproar. Second, very sensitive matters like this require a good deal of confidentiality at first, which is better accomplished by a smaller group.

If you suspect a staff member of fraud, should you terminate them or suspend them?

Sommerville: You don’t terminate the employee. You suspend them and say, “We’re looking at some items.” You don’t even need to tell them precisely what you’re looking at. Suspend them first and then issue a “preserve evidence order.” This means that the church suspends all document destruction until instructed otherwise. When it comes to electronic media, the church needs to preserve it without changes. It should not be turned on except by a forensic computer expert.

Call your accounting department and all your record keepers and say, “Stop, don’t change anything.” If the person suspected of fraud has a computer, don’t touch it. If they have a laptop, don’t touch it. You leave everything exactly the way it is right now because we don’t know where this is going to go. Sometimes they’re honest, and this is an honest mistake, and we resolve it fairly easily.

The other side is that you don’t know the size of the fraud. The Houston First Baptist case started with some questioning of credit card charges. My firm sees fraudulent credit card charges all the time. It also concerns me that many churches for convenience have gone to electronic statements and electronic approvals, and it’s fraught with opportunities for theft.

If you place the employee on a leave of absence, they can say whatever they choose to. There’s nothing you can do to stop them, but you can help the situation by explaining to people: “We have things we are looking into and we have been advised by our attorney not to discuss it publicly.” That usually gives enough gravity to the situation that no matter what is being said publicly by the person who is suspected, the people who really care are going to give you the benefit of the doubt.

You’re going to have situations where the person suspected of embezzlement is just as influential as this person was. They have a huge trust bank with the congregation. Those who are inclined to do bad things will exploit that trust bank to the maximum.

I don’t anticipate a suspension with pay would be for a long period of time. It’s just to give you enough to talk to the lawyer, talk to the public relations people, talk to the insurance company, and put your committees in place to investigate this so that then you can have a decision.

If you decide to terminate the employee, get together and have a meeting with the person suspected of fraud. The meeting will include the supervisor, HR representative, and maybe senior leadership. I don’t recommend you say, “We’re terminating you for theft” because it has not been adjudicated that he’s a thief yet. Instead, say, “There are irregularities, we have questions about them and we are going to terminate you because we have those questions.”

You will get requests to show grace and mercy to the accused. How should your church respond?

Self: That was the big question I got: “Where is the grace in this?” By “grace” they mean, “Cover it up. Let him go. Don’t do anything.” An attorney told me once, “David, without justice, you can’t have grace.”

Cummings: In the Bible, Paul wrote to the church and said, “Let him who steals, steal not.” In other words, he recognizes some church members are going to steal and they need to stop. If you say, “We’re going to show you grace, we’re going to forgive you, we’re going to restore you without any consequences,” you’ve really harmed that person and you’ve really harmed your church.

I understand the pain and agony of going through this with somebody in the congregation that you care about. All I’m saying is that, in my experience, when somebody says to me they stole X amount, the actual figure is usually more. They always understate it. There’s been a crime committed against not only the church but against the state. Forgiveness is great but there needs to be some accountability for what they did. I don’t see where grace has anything to do with anything until there’s accountability for what they’ve done.

Should a church enter into a restitution agreement in lieu of prosecution?

Sommerville: In 38 years of doing this, I have had several dozen churches enter into restitution agreements. I have yet to have a church receive the first payment. Restitution agreements make you feel good, but they don’t honor your members or the trust God gave you over their assets.

On the criminal side, to get a lighter sentence, they must provide the restitution. Restitution plays a key role in the length of time they serve. We’ve seen cases where they provided 100 percent restitution after they were charged and pled guilty where the judge gave them probation. But that’s pretty rare, depending on the size of the case.

Don’t let your congregation think in terms of restitution. We can still forgive them, but God’s Word says that he doesn’t always intervene on the consequences of our bad choices.

Self: If it’s all about restitution and forgiveness, then you’re setting up a culture of corruption within your staff and your church body. What you’re saying is, “Steal as much as you want, because if you get caught then you just pay it back and all is forgiven.”

What are best communication practices, both internally and to the community at large?

Self: A financial crime is a sin against the whole congregation. In Joshua 7, Achan’s theft and concealment of the spoils of battle affected the community. In our situation, the sin of theft impacted the congregation. It was hidden and it had to be brought to light, but in appropriate stages.

Early on, we met with the associate missions minister’s Sunday school class—he taught about 100 people on Sunday. We said there were some incongruities, that we did not terminate him, and that he voluntarily resigned.

We were legally constrained from saying much to the congregation and the community about the accusations. That put us in a difficult situation. It caused some real internal problems for us because we were not free to come out and say, “This is what happened.” The accused and those who supported him could say what they wanted to about us. I did get a text the first week from an attorney representing the the family of the associate missions minister that I could be sued for slander and libel.

Sommerville: You can’t call somebody a thief because they haven’t been determined to be a thief by a court. That’s a derogatory term. When the committee is doing the investigation, it’s very important that committee members not share their findings and discussions about the accused. You don’t want to create defamation or slander. Even though this person resigned, that didn’t stop the investigation and the need to be careful as to what was said in public.

Self: We engaged a crisis public relations firm, and followed their steps for communicating with the congregation, the community, and the media. We probably got them a month too late. We should have engaged them early on.

Sommerville: Notify your attorney that you’re going to get a PR firm involved pretty early, especially if you’re as high profile as Houston’s First Baptist. The attorney will work directly with senior church leadership regarding communications and PR.

Hiring a PR firm is money very well spent because you have to craft a message that is 100 percent truthful and yet not create liability. Public relations people know how to communicate and use words that will meet the legal standards, but will also satisfy the vast majority of your members.

Self: Our public relations firm said, “You need to identify the major donors who were affected.” Those would be the donors who have given large gifts to our missions restricted fund, from which the majority of funds were stolen. Since these donors were impacted the most by the theft, we felt they deserved an explanation.

The senior pastor and I, some members of the committee, and other senior staff made personal phone calls to all of those donors prior to this becoming public knowledge. We said, “This is what’s going on, these are the steps we’ve taken, and there’s probably going to be something in the news in the next 30 days.”

A high percentage of them said, “That’s terrible. I feel really bad for you. Now let me tell you of my story of embezzlement.” Almost all of those business owners had been through it and this was not news to them. That was a good step on our part to give a heads-up to some key people who might take this theft personally because it was their money.

Within 90 days of the publication of the indictment, we had two major gifts that have amounted to more than the amount of the theft. It wasn’t apples to apples. They weren’t paying us back for the theft. It wasn’t restitution at all. They were able to fulfill all those accounts, make whole what the moth has eaten, that sort of thing.

It was a spiritual thing for us that if we did the right thing, God was going to take care of his church.

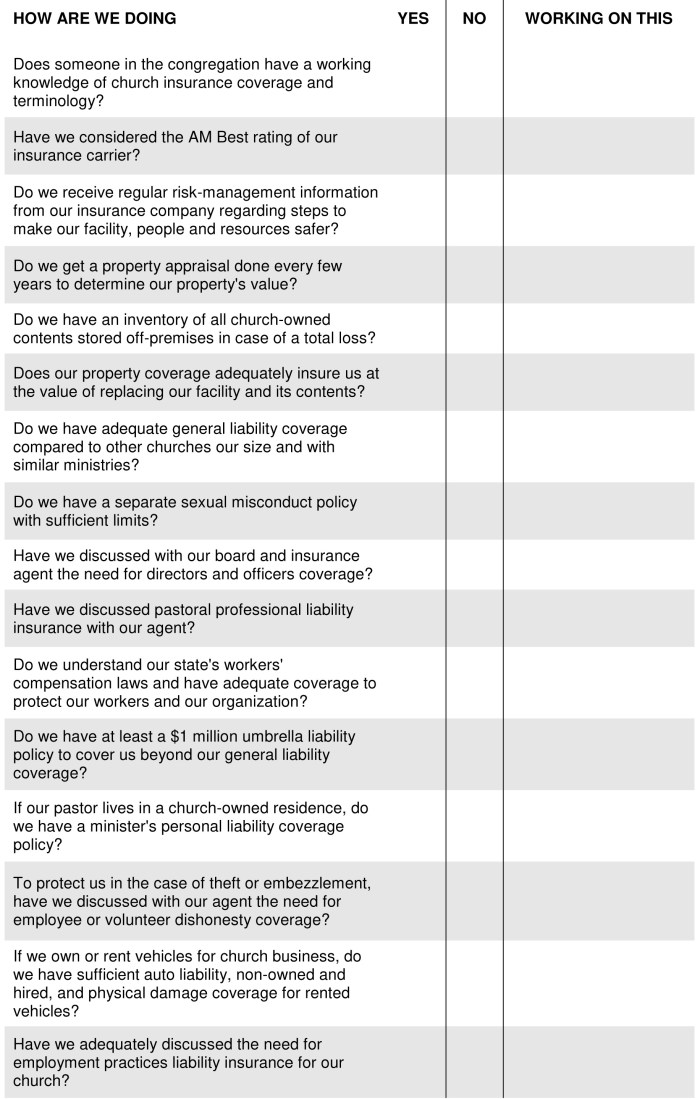

What advice or guidance do you have when it comes to insurance coverage and communicating embezzled funds?

Sommerville: Make sure you have theft coverage or employee crime coverage. You need to notify them as soon as you have a suspicion. You have to notify some companies within 10 days. Others are more lenient and allow 30 days. But if you don’t notify them, you waive coverage. Then you have suddenly given the insurance company an unintended blessing.

Self: Concurrent with notifying the insurance company, we had to cooperate with law enforcement. In the first meeting with the associate missions minister, we said, “We have no interest in prosecution. We don’t want you to go to jail. You have two young kids at home. We want to restore you.” That was our opening response when we had no idea about the size of this thing. But to cooperate with the insurance company means we had to cooperate with legal authorities.

Sommerville: That’s a condition the insurance companies are putting into their policies now. You agree to prosecute criminally if they pay out a claim.

Should a church that’s been embezzled get the IRS involved? If so, how?

Sommerville: Embezzled funds are taxable income to the embezzler. The church, as the victim, files Form 3949-A with the IRS to report the previously unreported taxable income. That is something I strongly recommend. Some people say you’re adding insult to injury, but it’s just a consequence of their sin. Not only is the IRS going to require them to pay the money back, but they’re going to impose a 225 percent penalty on them for taking it.

Putting it all together: What is the plan of action to follow if a church catches someone embezzling funds?

Cummings: Contact your lawyer first. You want the lawyer to control everything that is about to happen. You should do this even before you call the cops because your risk is getting sued.

Be careful that you do not end up with a lawsuit with a charge of libel, slander, or false arrest. Do not put in the church bulletin that you just caught somebody stealing money. Don’t publicly accuse anyone of fraud. Do not even talk about it outside of the people who need to know.

Consider engaging a certified fraud examiner to assist you with your case. They are trained in investigations of frauds and handling those frauds.

Seriously consider prosecuting the fraudster for everyone’s sake, including any future employers. Most people who commit major fraud in a church need to be prosecuted. The percentage of cases that do not get prosecuted is very high—75 to 90 percent. The number one reason is embarrassment that someone got away with it. Some people say, “If I prosecute them, I won’t get paid back.” Let me give you a clue: you’re not going to get paid back. Restitution agreements in my view are totally useless.

Be prepared to have your case fully documented when you go to the district attorney (DA). The DA’s office might have time for your case in a small town, but in a big city, they simply don’t have time. Harris County, Texas, where Houston is located, has only four fraud investigators and two police officers dealing with fraud. You have to bring them a case and actually convince them to take it.

Engage a private investigator. This person can help locate assets and other helpful facts such as secret businesses, conviction records, real estate transactions, divorces, and lawsuits. If you’re reconstructing where their money is, it’s very helpful to take these steps.

More than anything else, be alert and less trusting. Why is the trust level too high in a church or a nonprofit organization? Because nobody could imagine somebody stealing from God. So everybody trusts people to do what is right. Unfortunately, they don’t always do what is right. The trust level is so high no one ever checks up on them. If they did, they would catch them. Trust is not an effective internal control. It’s probably the worst internal control you could ever have.