Here’s to finishing 2024 strong and getting off to a great start in 2025!

1. Designate a housing allowance

A key end-of-year financial task for a church board or congregation should be designating a housing allowance for 2024 for ministers who own or rent their home (and for ministers who live in a parsonage and who pay some of their housing expenses from their own funds).

Find sample housing allowance and parsonage allowance resolutions in chapter 6 of Richard Hammar’s annual Church & Clergy Tax Guide.

“Because housing allowances can only be provided prospectively (that is, after they have been approved by the board or the board’s designee), obtain approval from the board prior to January 1,” advises Rob Faulk, a CPA and partner with CapinCrouse.

All employees should review their W-4 form and submit a new form if circumstances have changed. This will ensure accurate tax withholding.

“Many employees are surprised when they complete their tax return and find they owe money,” says Elaine Sommerville, a CPA and senior editorial advisor for Church Law & Tax. “Employees may be caught short on taxes paid if both spouses are working.”

She explained that the tax withholding tables “don’t appropriately take a dual-earner household into consideration. It is advisable for employees who owed money with their 2023 Form 1040 to complete a new Form W-4 at this time.”

And don’t leave out ministers, says Frank Sommerville, a CPA, tax attorney, and senior editorial advisor for Church Law & Tax. Unfortunately, “many ministers just go to the treasurer and say, ‘Withhold such-and-such from a paycheck,’” he said. “But the pastor should also fill out a W-4 or provide other written documentation for withholding income tax.” (For more information on this aspect of the topic, see #9 below.)

Tip. Visit the IRS’ publications site to download the 2025 edition of IRS Publication 15 for the new withholding tables. (This publication is regularly updated each December for the upcoming year.)

3. Provide a notice to donors

Advise donors in the church bulletin or newsletter, on the church website, or in a letter or email from the church, not to file their federal income tax return before they receive their contribution summary from the church.

Donors may not be able to deduct individual contributions of $250 or more if they file a tax return before receiving a qualified contribution receipt from their church.

Double-check the software the church uses to prepare charitable contributions receipts to confirm that the vital “no goods or services other than intangible religious benefits were provided” statement is included when the receipts are prepared.

“Making sure donors have those contribution acknowledgements prior to filing is definitely important,” added Kaylyn Varnum, a partner and assistant national director for tax services for the accounting firm Batts Morrison Wales & Lee, and an advisor-at-large for Church Law & Tax.

While deductions may be available to fewer donors, it’s still important to notify all donors, Frank Sommerville stressed, because churches simply don’t know who might qualify for a deduction.

Tip. Answer many of your members’ questions about charitable giving and tax law with the Charitable Contributions Tax Reminder (for their 2023 returns).

4. Determine if contributions are effective for 2024 or 2025

The general rule is that a contribution is effective when delivered. A check deposited in the church offering in January of 2025 cannot be deducted in 2024, even if it is backdated to 2024. One exception—checks mailed and postmarked in 2024 are deductible in 2024, even if they are not received until 2025.

IRS Publication 526 offers these guidelines for three other types of giving (adapted):

- Text message. Texted contributions are deductible in the year the donor sends the text message if the contribution is charged to the telephone or wireless account.

- Credit card. Contributions charged on the donor’s bank credit card are deductible in the year the donor makes the charge.

- Pay-by-phone account. Contributions made through a pay-by-phone account are considered delivered on the date the financial institution pays the amount. This date should be shown on the statement the financial institution sends the donor.

5. Correctly handle gifts and noncash/cash benefits to staff and volunteers

Consider these two categories of gifts:

- Cash Christmas gifts to employees. Be sure to correctly handle any Christmas gifts made by the church or congregation to a minister or lay staff member. In most cases, these transfers represent taxable income and not a tax-free gift and must be reported as income on the recipient’s W-2.

“If the gifts are paid through accounts payable, the value of the gifts will need to be submitted to the payroll system prior to the end of the year to allow for correct reporting on the recipient’s W-2 and on the church’s fourth-quarter Form 941,” Elaine Sommerville explains.

- Noncash gifts to employees and volunteers. Noncash gifts may also create income requiring payroll reporting. A gift of property having a value so small “as to make accounting for it unreasonable or administratively impracticable” is a nontaxable “de minimis fringe benefit” (see Section 132(e)(1) of the tax code). This exception does not apply to cash or “cash equivalents” (such as gift certificates).

“Information on noncash gifts that may not be considered as ‘de minimis’ will need to be provided to the payroll system prior to the end of the year to allow for correct reporting on the recipient’s Form W-2 and the church’s Form 941,” Elaine Sommerville says.

Avoid monetary gifts (including gifts cards) to volunteers of any amount, says Frank Sommerville.

“Once you give people money, they are no longer volunteers,” he says. “They are employees. Once you compensate them, then you’re getting into all kinds of issues. Does employment law apply? Does workers’ comp apply? Once you give them anything of value, they no longer qualify as a volunteer under many, many statutes.”

6. Be careful about accepting certain types of end-of-the-year noncash donations

Near the end of the year, churches should be wary of a noncash donation of significant value, such as an antique car or a gift of real estate. Some gifts might be hard to sell. With land, there could be unresolvable zoning issues or issues with toxic soil. With a building, there could be structural issues or a problem with lead or asbestos.

“You don’t want to be rushed into making a decision,” says Frank Sommerville. “If a gift comes in near the end of the year, you don’t have the time to do your due diligence.” He stressed that the gift could end up costing you a lot more than it is worth.

An exception: publicly traded stock. “Stock is pretty easy to address appropriately as a year-end gift,” he says.

Additional resources: “Gifts of Property: Help Donors Get It Right” offers tips on handling noncash gifts of real property (buildings and land) while “Tax Rules for Gifts of Personal Property” offers tips on handling noncash gifts of personal property (such as cars, household items, and stock).

7. Review classification of employees for US Department of Labor (DOL) purposes

“Now is the time to decide if employees are properly classified for wage and hour purposes,” Elaine Sommerville says. “Review job descriptions to determine if employees qualify for the ministerial exception. Then review job descriptions for non-qualifying employees and decide if they’re exempt or non-exempt.”

This step cannot be overlooked for 2025 because there has been a lot of uncertainty regarding the minimum weekly salary requirement for exempt employees under the federal Fair Labor Standards Act (FLSA).

The requirement was set to increase substantially through a phased approach starting July 1, 2024, and again on January 1, 2025. However, in November of 2024, a federal court in Texas vacated the DOL’s proposed changes. For now the minimum salary requirement for exempt employees remains $684 per week, or $35,568 per year.

With so many changes occurring between the DOL and the courts, it’s wise for churches to again review the compensation of exempt employees. Should any fall below the current threshold, they must be reclassified. It is still possible to compensate nonexempt employees on a salary arrangement. A church needs to take special steps with these arrangements, such as considering a strict no-overtime policy and requiring weekly timesheets from the new nonexempt employees.

For further guidance, see Elaine Sommerville’s article “The Right Way to Handle Wage Classifications.”

8. Make sure ministers are properly classified for paying into the Social Security system

Separate from applying the DOL’s ministerial exception discussed above, a church must also determine who is a minister for IRS and Social Security purposes.

Many churches incorrectly report ministers as employees for paying into the Social Security system by withholding Social Security and Medicare taxes from their wages. This is incorrect, since the tax code classifies ministers as self-employed for purposes of paying into the Social Security/Medicare system with respect to services they perform in the exercise of ministry. As a result, they pay the self-employment tax with their individual income tax returns and not through withholding and employer matching of Social Security and Medicare taxes.

Now is also a good time to provide information to ministers regarding their unique tax classifications to make them aware of the unusual filing requirements.

Caution. Ministers who are incorrectly classified for Social Security and Medicare jeopardize their ability to receive the tax-free housing allowance. The ideal time to reclassify these ministers as self-employed for Social Security is January 1 and the prior year’s reporting should be corrected to preserve the other benefits afforded to ministers.

9. Voluntary withholding

Since ministers’ wages are exempt from Social Security, Medicare, and federal income tax withholding (with respect to services performed in the exercise of their ministry), they use the quarterly estimated tax procedure to prepay their federal taxes.

However, ministers who report their income taxes as employees can enter into a voluntary withholding arrangement with their employing church by submitting written authorization—such as a letter, email, or a W-4 form—to the appropriate church representative. Under such an arrangement, the employing church withholds income taxes as it would for any other employee and also can withhold an additional amount of income taxes to cover the minister’s self-employment tax liability.

Tip. The ideal time to start voluntary withholding is January 1. However, Ted Batson, a CPA and tax attorney with CapinCrouse, and an advisor-at-large for Church Law & Tax, says adjustments in voluntary withholding can be made at any time during the year.

In addition, some churches have filed a Form 8274 with the IRS exempting themselves from the employer’s share of Social Security and Medicare taxes. As a result, lay employees of these churches are responsible for making quarterly estimated self-employment taxes to the IRS.

If the employee requests additional voluntary withholding, the church withholds an additional amount of federal income taxes to cover their estimated self-employment tax liability.

“For ministers who prefer to make estimated tax payments rather than allowing the church to withhold federal income tax, it is beneficial to enroll in the IRS Electronic Funds Transfer Payment System (EFTPS),” Elaine Sommerville suggests. “Making tax payments through the EFTPS system provides the minister with the ability to preschedule estimated tax payments and to receive immediate confirmations of the payments.”

10. Review plans for compensation in 2025

Review compensation and benefits for employees for the upcoming year. Doing so will “provide for the proper documentation of compensation packages and proper taxation of benefits provided to employees,” says Elaine Sommerville.

Additional resource: Find help for your various compensation issues in Elaine Sommerville’s book, Church Compensation, Second Edition: From Strategic Plan to Compliance.

11. Have applicable employees fill out various required elections

Certain plans require benefit elections by the beginning of the plan year. These include benefit elections for a church’s cafeteria plan or Section 125 plan, enrollment in insurance plans that begin on January 1, and the required health insurance opt-out election certificates required by large employers.

For any church that’s an applicable large employer—and currently in its annual benefit enrollment period—Rob Faulk from CapinCrouse offers this guidance: Ensure that any employee who chooses to opt out of the health benefit plan completes an opt-out election certificate [or waiver] and furnishes proof of enrollment in another qualified group health benefit plan from a source other than your church’s plan before coverage is terminated.

12. Review payments to any independent contractors

Preparations for filing the annual Forms 1099-NEC should include a review of payments to unincorporated independent contractors, including LLCs, and their related W-9 forms. (Credit card or PayPal payments are not reported on the Form 1099-NEC.)

With this task, it’s important to remember the electronic filing requirements for churches filing 10 or more reporting forms of any type and make plans to identify a provider who can accomplish this task (see Task #14 below for more information).

“If a Form W-9 hasn’t been obtained for a contractor, determine if the church has the correct address and Social Security/employer identification number for the contractor,” Elaine Sommerville stressed. “And don’t forget to include payments to attorneys even if paid to a law firm that is incorporated.”

Tip. The Form 1099-MISC is still used for other reportable payments, so make sure the church orders the right forms to report all necessary payments. For example, payments made to unincorporated lessors are still reported in Box 1 of Form 1099-MISC. Forms 1099-NEC are due to the IRS and the recipients by January 31, 2025, and Forms 1099-MISC are due to recipients by January 31, 2025, and to the IRS by February 28, 2025.

Did your church give a low-interest or interest-free loan to your pastor this year?

How about forgiving interest or principal on a loan to your pastor during the year?

Could employees’ children attend your summer camp without charge? Did you provide employees with free memberships to the local gym?

The value of such benefits needs to be reported on your employees’ W-2s “and included on your Form 941 with tax withholdings and payroll taxes paid as applicable,” Batson says.

“Whenever possible, taxes for fringe benefits should be withheld throughout the year and at the time the fringe benefit was received,” Batson says. “But in cases where that has not happened, the value of the fringe benefit should still be included on the W-2s at the end of the year.”

Elaine Sommerville adds that “taxes associated with the fringe benefits may still be calculated and paid through additional withholding from employees’ final paychecks this year, if not calculated at the time the benefit was provided.”

“Fringe benefit plans should be reviewed to determine the plan documents are still in compliance with applicable law and the church is operating within the boundaries of the applicable benefit plan,” Elaine Sommerville says.

“A church that provides its minister a car should download IRS Publication 15-B and review the Fringe Benefit Valuation Rules to ensure the proper amount for personal use is included in the pastor’s W-2,” Batson says.

The IRS requires electronic filing for 10 or more 1099, W-2, and many other forms.

There are many easy systems allowing for electronic filing of payroll reports. The Social Security Administration maintains a portal for filing Forms W-2 electronically for smaller employers.

The IRS has created the Information Returns Intake System (IRIS) as a free system for meeting electronic filing requirements. Filers must register to utilize the IRIS system.

Local office supply stores sell hard copy forms for the few employers who may use them. While irs.gov/forms, offers many forms for download, Form 1096, Form 1099-MISC, and Form 1099-NEC still require original, red-colored forms when filing paper forms.

15. Finalize 2025 budgets and take care of any budgeting issues

If your current budget year ends on December 31, finalize your 2025 budget before then, Faulk advises. Further, he says to perform a variance review of income statement (actual vs. budget). “This process may affect decisions about next year’s budget and may be particularly challenging due to the changes caused by the pandemic,” Faulk explains. “To help, CapinCrouse offers a free e-book, How to Budget Effectively in Changing Times.”

Additional resource: “Some Churches Keep Their Budgets Rolling,” by CPA Michael Batts provides insights on how to closely monitor income and expenses during unpredictable economic circumstances.

16. List and take care of any additional year-end items

Sit down and list any additional items that could easily slip through the cracks, which are particular to your church, then take care of them before the end of the year. Faulk mentions the following items:

- Reconcile your church’s donor system to your general ledger, and then investigate any significant differences. This is an important internal control to help detect any errors and to prevent fraud.

- If your church has a loan, talk to your lender about instances of noncompliance before the end of the year.

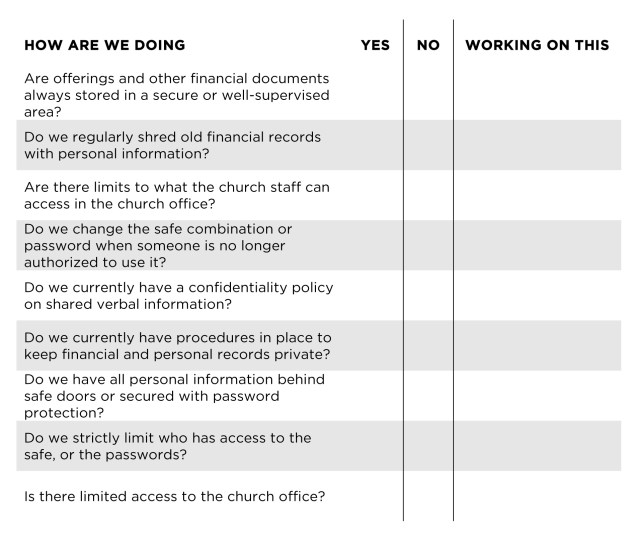

- Learn more about how many of these year-end steps are effective tools for preventing financial fraud in your church.

- Review and sign annual conflict-of-interest forms.

- Reconcile detailed property and equipment depreciation listings to the general ledger.

- Record destroyed items in accordance with document retention and destruction policies.

- Review insurance policies and update as appropriate.

- Document a list of authorized check signers and update bank records.

- Document a list of those authorized to approve expenditures.

- Document a list of approved bank accounts. Close the ones the church no longer needs.

- If your church will have an audit or review, your finance or audit committee should be in the process of selecting the independent auditors.

- Make sure the church has adopted an accountable expense reimbursement plan and makes it available to all employees, especially those with church-issued credit cards.

- Confirm the church is still in good standing with the state where it formed and make sure the name and address for the registered agent is current.

17. Update your church’s resource guides

Now is a good time to order Church Compensation, Second Edition: From Strategic Plan to Compliance by Elaine Sommerville. It’s also a good time to preorder the 2024 edition of Richard Hammar’s Church & Clergy Tax Guide. Both can help answer the various tax, payroll, and compensation questions that will invariably arise next year.

The editorial team of Church Law & Tax is made up of Matthew Branaugh, attorney-at-law, and Rick Spruill, digital content manager.